URD 2024

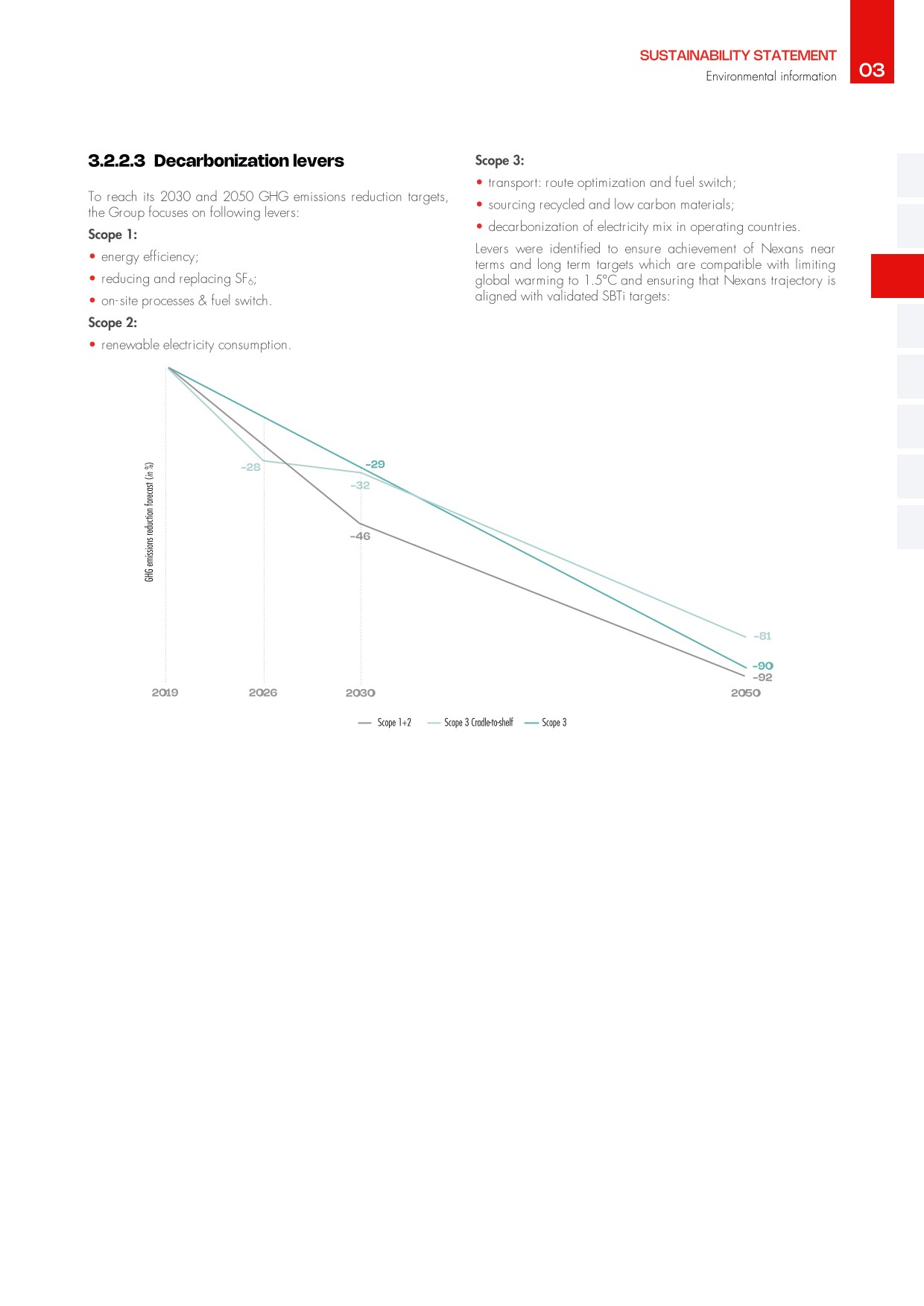

-

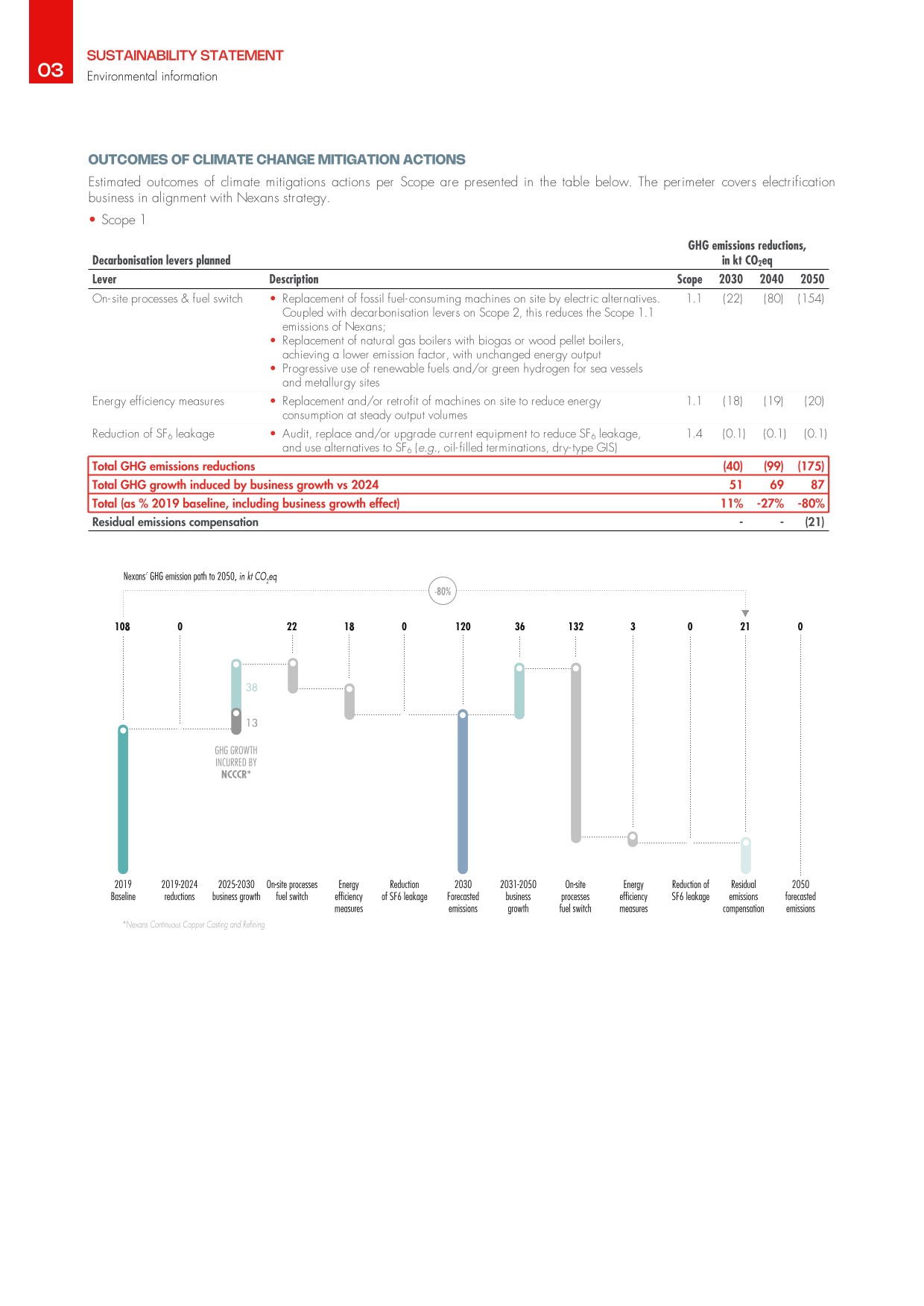

1.1History of the Group

Nexans has always played a major role in the history of electricity, from its discovery by Thomas Edison and Benjamin Franklin to the new electrified world, and is amplifying its role by becoming a pure player in this field.

A cable pioneer

1879: Thomas Edison created his first high resistance, incandescent electric light. At the same time, two entrepreneurs, the Swiss engineer François Borel and business man Edouard Berthoud, invented a waterproof electric cable. They formed Berthoud, Borel et Cie to develop the system, which consisted of wrapping wire with bituminous paper, which was then sealed with lead. The invention caused a revolution in a number of nascent industries, notably in the telecommunications and electrical power industries.

They created Société d’Exploitation des Câbles Électriques (SCE) to build the first cables: Nexans was born.

1881: Société d’Exploitation des Câbles Électriques successfully presented its lead sheet at the first International Electricity Exhibition in Paris and was awarded the lighting of the Champs Elysée for the 1900 Paris Exhibition.

1897: Creation of Société Française des Câbles Électriques in Lyon, an affiliate of the Swiss company Berthoud, Borel et Cie, to manufacture cables using the Berthoud and Borel system.

1912: The Compagnie Générale d’Électricité (CGE) took a majority holding in Société d’Exploitation des Câbles Électriques which had already become one of the most prominent companies in France’s growing electrical power sector, with operations spanning across both power generation and distribution, and manufacturing.

1925: Merger of Compagnie Générale des Câbles de Lyon with CGE. Câbles de Lyon became a division of CGE.

1938: CGE acquired Société Industrielle des Téléphones of which cable plants in Bezons and Calais were transferred to CGE-Câbles de Lyon.

1969: CGE acquired Alcatel, founded in 1879 as Société Alsacienne de Construction Mécanique, and which had become one of the leading manufacturers of telecommunication technologies. The Alcatel acquisition boosted CGE’s own telecommunication business, CIT. The two companies merged to form CIT-Alcatel, stepping up Câbles de Lyon’s business.

-

1.2Strategy

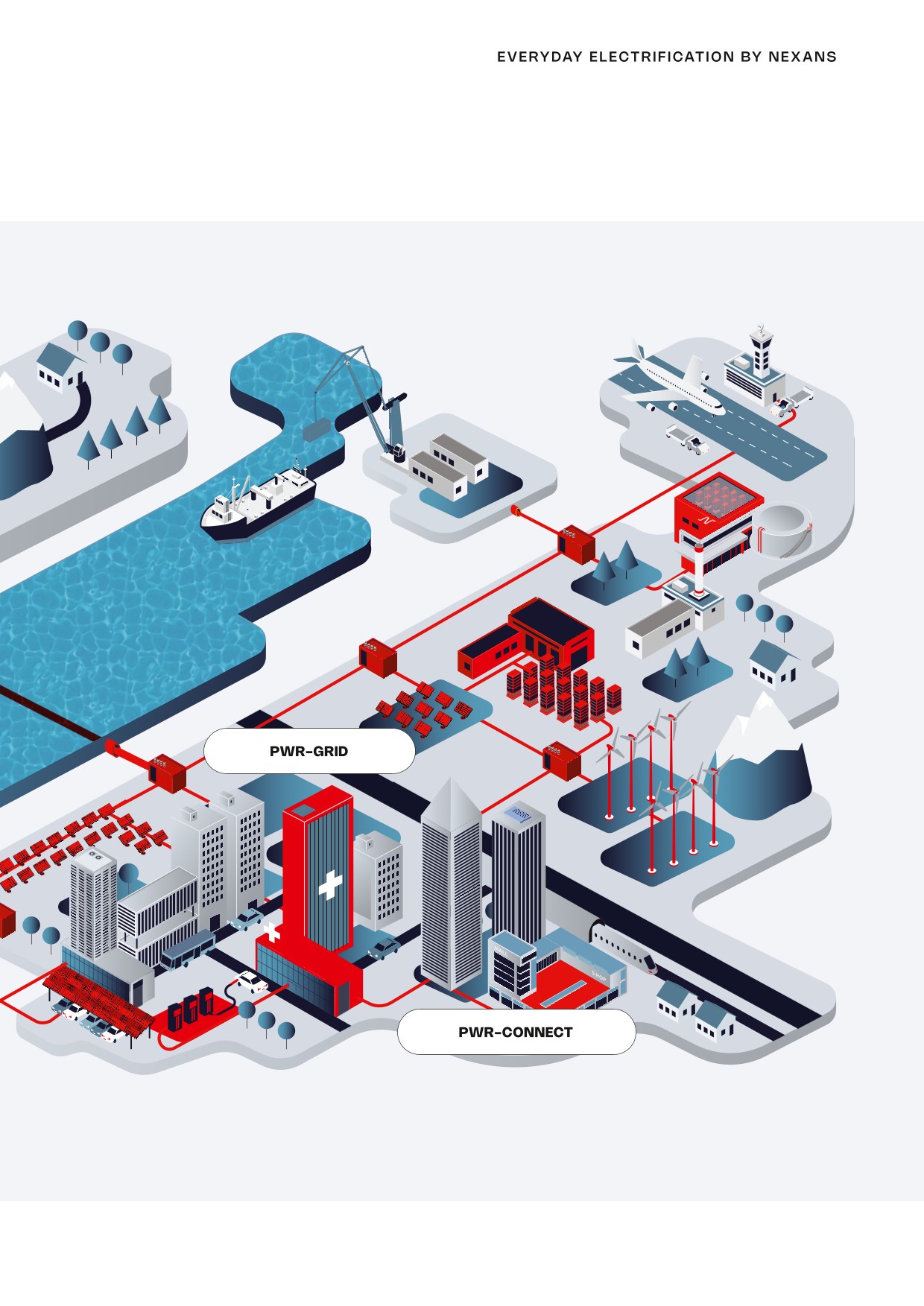

1.2.1Megatrends

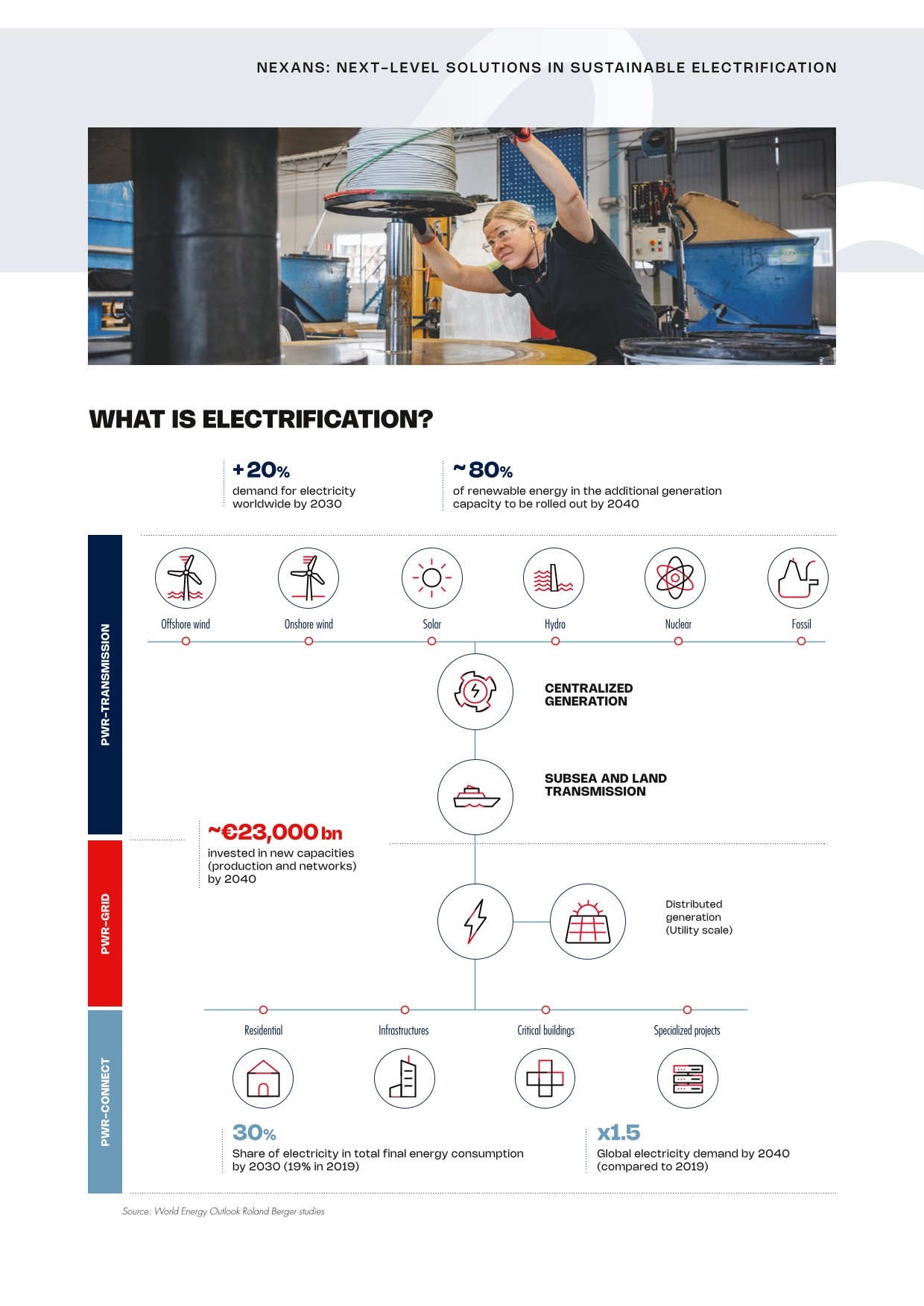

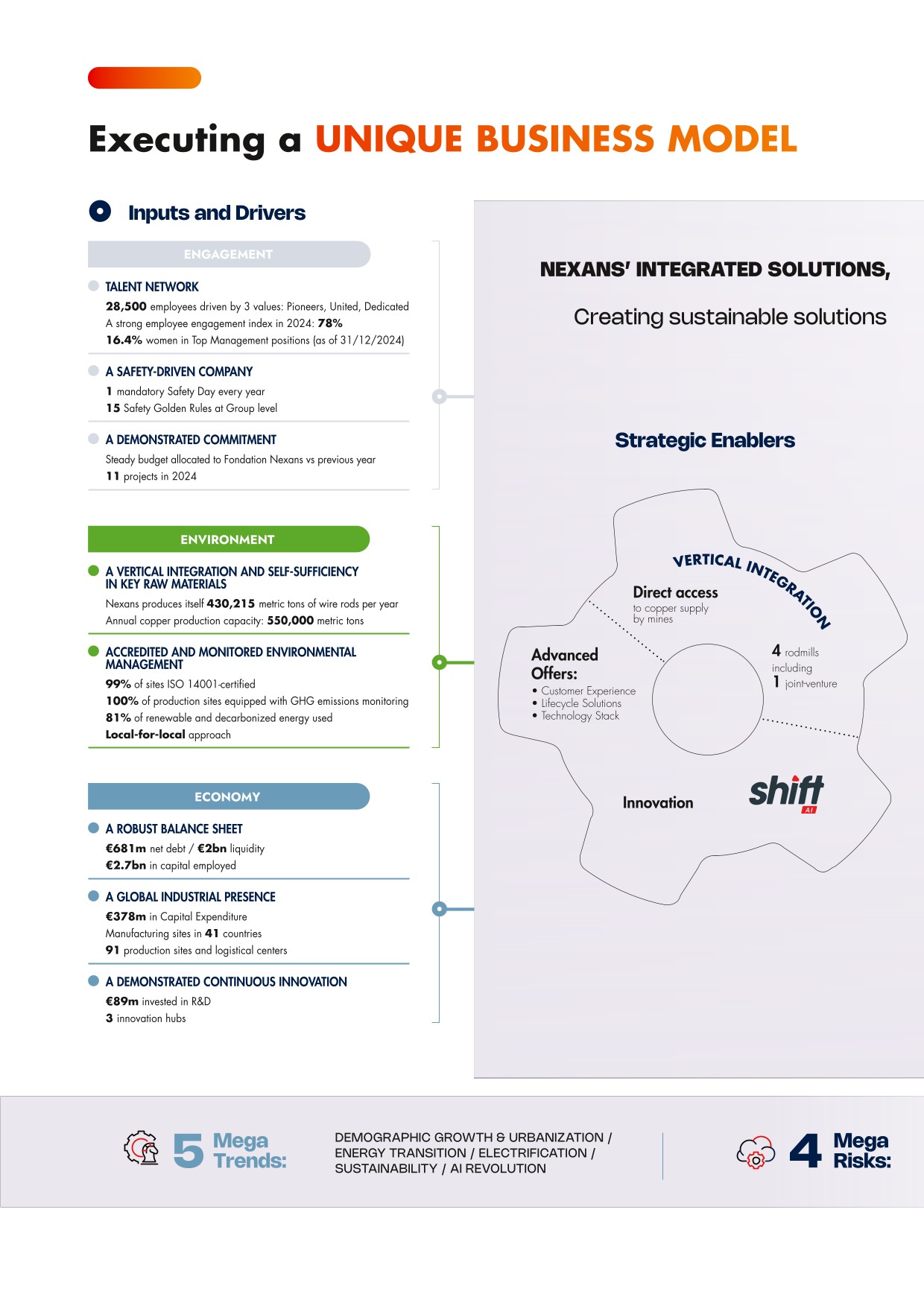

The global electrification revolution is accelerating, driven by a convergence of profound megatrends that define the energy and infrastructure landscape. Nexans, as a leader in the electrification space, has positioned itself to address these transformative forces.

Decarbonization and energy transition

The urgency of addressing climate change has placed decarbonization at the forefront of global priorities. Electrification is the fastest path to a low-carbon future, with renewable energy sources projected to ensure 80% of the global power generation by 2050. This transition demands enhanced grid infrastructure to integrate renewables and support the rising complexity of power systems.

Electrification and rising energy demand

Electrification underpins the world’s pathway to sustainability, with electricity demand forecasted to grow six times faster than overall energy demand. This trend is fueled by the adoption of electric vehicles, increased use of renewable energy systems, and the electrification of buildings and industries.

Urbanization and population growth

Rapid urbanization is driving demand for resilient and efficient energy systems in densely populated areas. Critical infrastructure, such as hospitals, data centers, and industrial complexes, requires specialized, high-performance electrical solutions to ensure safety and reliability.

AI revolution

The Artificial Intelligence (AI) revolution is a significant megatrend impacting various sectors, including the energy industry. Data Centers are expected to account for around 10% of global electricity consumption by 2030. Besides, the integration of artificial intelligence into energy systems is reshaping customer expectations and operational efficiency.

Sustainability

The convergence of electrification needs in both developed and emerging economies has created unprecedented pressure on global supply chains. The frequency and intensity of climate-induced disasters, such as storms and wildfires, have surged. Electrical infrastructure must be resilient to these risks, ensuring continuity in energy supply to safeguard lives and economies. Raw material shortages, particularly in copper and aluminum, combined with geopolitical risks, emphasize the need for sustainable resource management and recycling initiatives.

-

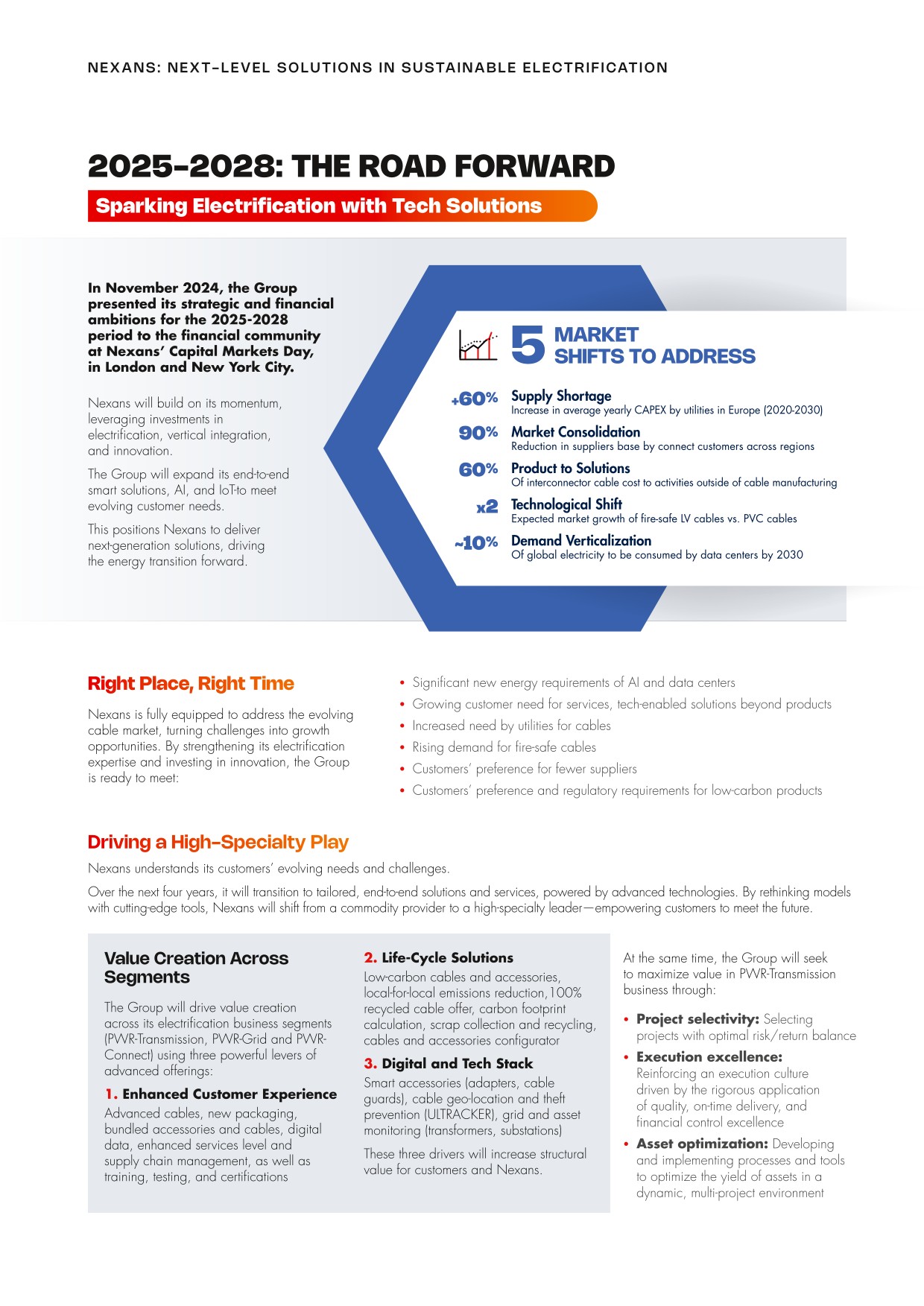

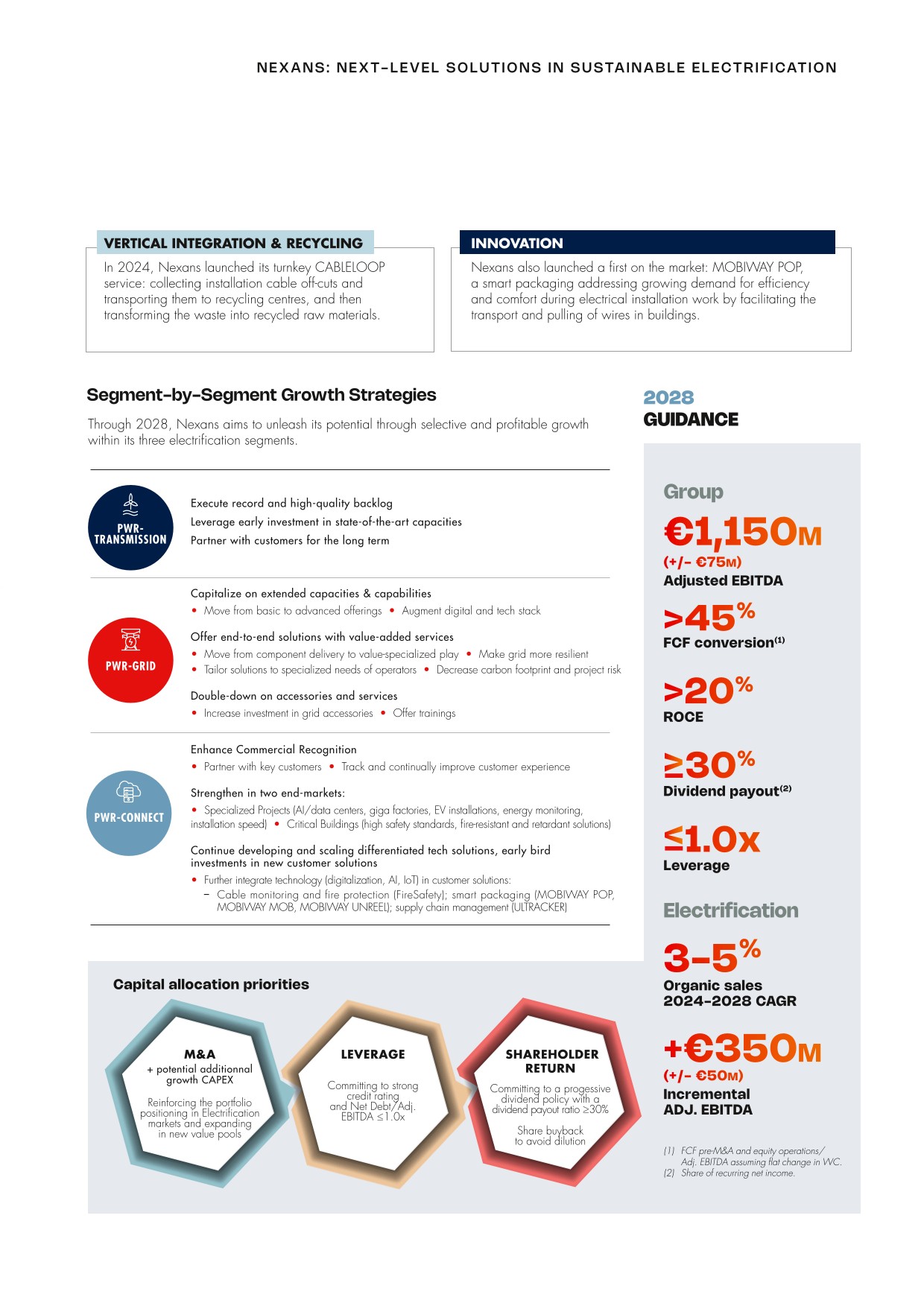

1.32025 trends and outlook

In 2025, Nexans expects to benefit from continued buoyant market demand, supported by global megatrends in electrification, as well as its structural transformation and value-added solutions to support its growth and profitability improvements. The Distribution market is currently entering a hyper cycle of investment. The record risk-reward backlog in Generation & Transmission provides solid visibility.

-

1.4Description of business segments and markets

With a unique level of integration, from metallurgy to recycling, the Group offers its customers a unique proposition: cutting-edge cabling technologies and services, tailor-made support and solutions for the entire value chain – engineering and design, production, installation and maintenance.

1.4.1Electrification businesses

1.4.1.1PWR-Transmission

The PWR-Transmission segment (previously Generation & Transmission) is at the heart of the energy transition and sustainable electrification. It provides high-voltage cables and services for the connection of offshore wind farms to land, short or long distance, as well as for transnational land or subsea interconnection projects between electricity production and consumption areas.

The Group also manufactures submarine data transmission, monitoring or power cables connecting floating vessels to subsea infrastructure or interlinking subsea infrastructures.

Nexans provides a fully integrated offering from early engagement, design and engineering, manufacturing and installation to business continuity solutions such as inspection, maintenance and repair. The Group’s value proposition is based on four pillars:

- ●solid experience in project execution;

- ●strong risk management system through a unique risk-reward modeling process and continuous innovation to detect any failures;

- ●state-of-the-art cable manufacturing and installation assets;

- ●cutting edge technologies with the highest voltages: mass impregnated (MI), cross-linked polyethylene (XLPE) and dynamic cables.

Nexans has made several major investments in this activity in recent years to double its manufacturing capacities. The business’ industrial footprint is now the following:

- ●three subsea high-voltage facilities in Halden (Norway), Charleston (United States) and Futtsu (Japan);

- ●a land high-voltage facility in Charleroi (Belgium);

- ●a special telecom facility in Rognan (Norway).

The Group currently owns and operates two cable laying vessels: Nexans Aurora, the most technologically advanced cable laying vessel in the industry with over 10,000 metric tons of cable load capacity, and Nexans Skagerrak, with the longest track record of the industry. Nexans invested in the Nexans Electra, a new ultra-modern, technology advanced, cable-laying vessel to be equipped with a state-of-the-art logistics and handling system capable of laying four cables simultaneously and expected to be operational by 2026. Nexans is able to install and repair cables at water depth beyond 2,000m, enabling critical links to be established in deep-water environments such as the Mediterranean Sea.

As a long-term partner, Nexans has developed long lasting relationships and credentials with major offshore wind developers, such as Ørsted or Equinor, and Transmission Systems Operators (TSO), such as RTE, Terna, ADMIE or TenneT. In May 2023, Nexans secured a 1.7 billion euros frame-agreement from TenneT for turnkey high voltage direct current projects for offshore wind farms in Germany.

Market trends

The PWR-Transmission sector is growing at 10% annually, from 16 billion euros in 2023 to 26 billion euros by 2028(1), driven by regional interconnections and offshore wind farms. Renewables are expected to make up 80% of the energy mix by 2050(2), increasing grid complexity and the need for advanced power transmission solutions.

Offshore wind energy development has reached varying stages of maturity on a global scale. While it has become a mature and established market in countries such as Denmark, Germany, and the United Kingdom, where commercial parks have been operational for over two decades, it is still in its early stages in many regions, including the U.S., Japan, and parts of Asia. Despite this, offshore wind already represents an important and growing market for power cables. Projections indicate that approximately 275 gigawatts of new offshore wind capacity will be installed worldwide by 2030, with this figure expected to exceed 390 gigawatts by 2032, driven by accelerated efforts to decarbonize electricity supply.

This growth is underpinned by significant improvements in competitiveness, widespread acceptance, and regulatory pressure in favor of renewable energies. Notably, floating wind technology is poised to open new market perspectives, facilitating projects in areas such as the Mediterranean, South Korea, Scotland, and the west coast of the U.S., where deep waters had previously limited offshore wind development. Furthermore, planned and ongoing projects are increasingly larger, deeper, and farther from the shore, making technology and risk management pivotal differentiators for customers.

The sustainable electrification of the world requires the increase in energy production capacities, in particular from renewable sources, but also the increase of interconnections able to transport more energy over longer distances at sea and on land, thus the exchange of energy between countries to fully exploit the potential of renewable energies, which are characterized by intermittent production. By increasing the connectivity between national electricity grids, it is possible to match electricity supply and demand at the transnational level, stabilize the electricity supply of countries, and reduce blackouts, shortages and price fluctuations.

1.4.1.2PWR-Grid

Cables and electrical accessories are key elements of the electricity value chain to transport the energy produced to its point of consumption. Distribution system operators (DSO) provide electricity distribution via overhead lines and underground cable systems. Nexans designs and manufactures medium- and low-voltage cables from 700 V to 72 kV and medium- and low-voltage accessories from 1 kV to 145 kV. Through a comprehensive suite of integrated services, including specialized training for the installation of underground cables and their connecting accessories, cables systems engineering, installation supervision, and extended warranty coverage, the Group delivers turnkey solutions that empower operators. These solutions encompass a wide spectrum of offerings, from high-quality cables and accessories (such as connectors, bushings, terminations, joints, and splices) to cutting-edge services designed to optimize network operation and maintenance. By offering this holistic range of products and services, the Group is committed to supporting operators in their journey towards network modernization and operational excellence.

- ●long-term framework agreements with major energy distribution operators;

- ●turnkey solutions for electrification and bundled offers including cables and accessories for renewable or energization projects; and

- ●a revolutionary technologies: from shock-proof to low-carbon cables, or cutting-edge superconductivity.

In addition, the Group has developed innovative digital solutions: Asset Electrical, an asset management solution from Nexans powered by Artificial Intelligence specially designed to help network operators obtain maximum returns on their electricity network; or Ultracker , a unique solution using IoT technologies to locate drums in real time, in order to optimize their management, logistics and turnaround times while avoiding the loss and theft of cables and reels.

The Group has a long-term relationship with its strategic DSO customers – Enel, Enedis, E-On, Fluvius, UKPN, SSE renewable energy operators such as Enel Green Power, ERG; and, in some countries, major energy installers such as Vinci, Eiffage, etc.

The PWR-Grid segment operates globally in Europe, North America, Asia-Pacific, Africa and the Middle East, through a local industrial presence and through European Accessories plants serving 90 countries.

Market trends

Massive investments of around 10 trillion euros by 2030(3) will be made globally for the development of networks, mainly due to global electrification and the development of renewable energies. All over the world, DSOs are facing an increase in investments to develop and replace aging electricity networks.

The expected investments in renewable energies, data centers, giga factories are generating new connection needs, while the increasing electrification of emerging countries is leading to the development of new electricity grids to cover isolated areas.

In industrialized countries, massive investments will be necessary to modernize aging infrastructures, ensure the security and reliability of networks and cope with the energization of data center and AI gigafactories projects, particularly in Europe and North America.

The PWR-Grid market is expected to grow by 7% annually, increasing from 26 billion euros in 2023 to an estimated 37 billion euros by 2028(4).

1.4.1.3PWR-Connect

The Group designs, manufactures and distributes low-voltage cables (<1kV) and related accessories for electrical systems connecting the terminated point of the energy distribution network to the end user’s power outlet. This market addresses the usage of electricity in residential, infrastructures, industrial, commercial, datacenters and e-mobility end-markets.

- ●the electrical safety of end users;

- ●products that are easy to handle and install;

- ●smart products integrated into a digital ecosystem.

Nexans pursues a strategy of differentiation through technical performance and its ability to offer its customers solutions and systems beyond cable to support them in their projects before, during and after. This is supported by a wide range of services, including professional training, recycling services, shared inventory management at distributors’ premises, and digital services for asset management.

The Group is expanding its range of solutions for clients by introducing new packaging solutions through the MOBIWAY smart packaging, and also providing a comprehensive fire safety offering, to Electrify the Future in a safer way for people and assets. The Group also develops sustainable and environmentally-friendly products in order to reduce their environmental impact, in particular by integrating recycled products into its cables or offering recycling solutions to its customers.

The Group’s main customers are global specialized electrical distributors such as Rexel, Sonepar or Wesco, international purchasing groups like Imelco and Fegime, large electrical installers (Vinci, Eiffage, Bouygues Construction, etc.) and retail distributors such as Brico Depôt, Leroy Merlin, Sodimac and Bunnings.

The segment operates in Europe, North America (primarily in Canada), Asia-Pacific, Africa and the Middle East, thanks to its strong distribution network and a local presence to reduce transport-related CO2 emissions.

Market trends

In an increasingly electric world, electricity consumption is expected to be multiplied by 3 by 2050. In this context, the cable market is estimated at 74 billion euros in 2023 and is expected to grow at a rate of +5% per year to reach 94 billion euros by 2028(5). This dynamic is supported by different drivers depending on the region:

- ●emerging countries are mainly driven by ongoing urbanization, improvement of housing standards in urban areas, and electrification of buildings in rural areas;

- ●industrialized countries are mainly driven by heavy transformation: improvement of building safety, energy positive/smart buildings, decreasing energy consumption, transforming the role of buildings including local energy production, storage capacity and electrical charging stations.

-

1.5Innovation and technology

With a unique vision on the market, fully dedicated to electrification, Nexans makes a point of offering all its customers the highest level of services and innovation.

This is not only a differentiating marker of the Company, but also plays a key role in the Group’s financial and non-financial performance: it contributes to Nexans’ growth in value through the development and marketing of new offers, while meeting the new challenges of its customers. The Group is positioned at the heart of promising markets thanks to its solutions for the energy transition, the climate and the protection of people and infrastructure.

The Group’s spending on innovation amounted to 89 million euros in 2024. This amount illustrates the Group’s commitment to developing and maintaining a portfolio of innovations, often co-developed with a solid ecosystem of partners, to serve its operational excellence.

More than 800 experts and engineers work in dedicated entities or contribute to innovation through the development and marketing of new offers and products. Lastly, patented inventions contribute to the Group’s competitiveness and the differentiation of its offers, and illustrate its capacity for technological innovation. With more than 60 new inventions protected under first patent applications in 2024 in various regions, Nexans is among the top patent applicant in its industry. Nexans’ global portfolio comprises more than 1,700 patents.

1.5.1Innovate with ecosystems

Nexans relies on its Design Labs and Technocenters including AmpaCity, its new global innovation center, inaugurated in Lyon (France) in 2022, to federate its innovation ecosystems.

To meet and anticipate the challenges of its customers, Nexans has created a network of Design Labs responsible for managing the design, development and industrialization of new offers, based on an in-depth analysis of customer and market expectations:

- ●the Digital Design Lab is dedicated to the development of digital services and solutions based on technologies such as cloud, artificial intelligence (AI) and the Internet of Things (IoT);

- ●the Electrical Grid Design Lab helps network operators optimize the performance and reliability of their electrical infrastructure, from generation to distribution to the end user;

- ●the Building Design Lab focuses on the needs of customers, users and installers of cabling systems for buildings. It aims to facilitate the installation of cable networks, improve electrical safety and fire protection, and contribute to Smart Buildings.

The Group’s new Innovation Center in Lyon embodies its commitment to dedicate all of its research to sustainable electrification. The research covers electrical insulation performance (including very high voltage and aging), the ability to anticipate and detect failures, the development of materials with reduced environmental impact, fire-rated cable systems, cable production processes and digital technology. The Innovation Center employs 90 Nexans engineers and technical experts from different countries.

In order to accelerate the development of unique solutions, Nexans has partnered with leading industrial and technological players.The Group has signed strategic partnerships with leaders in its ecosystem such as Bureau Veritas, Digital Matter, Suez and Schneider Electric for a joint program to accelerate its digital transformation.

In particular, Nexans has signed a partnership agreement with Orange Business Services for the provision of IoT connectivity and has set up partnerships with Microsoft Azure to develop enhanced artificial intelligence and cloud solutions to transform the customer experience and ensure just-in-time delivery. It also developed partnerships with Suez to improve the separation between mixed plastic and metal scrap to increase the usage of recycled material.

Nexans is also involved in collaborations with universities, research centers and foundations (SuperGrid, EnergyVille, universities, CNRS laboratories, CurrentOS) for technology development projects, in particular on cable aging and the behavior of insulation under very high voltage, the development of recycling solutions, and new DC electrical architectures. In particular the Group is engaged in two collaborative projects supported by the France 2030 program: Ophelia for the development of medium voltage direct current solutions for long linear solar farms, and the RENOV initiative which is dedicated to the advancement of technologies for recycling cross-linked polymers.

In PWR-Transmission, early engagement and innovation with our key customers is an important vehicle to drive product and system development and close technology gap for future projects. During the year Nexans have had innovation projects with particular focus on dynamic export cables for floating offshore wind to address the challenges in the upcoming floating offshore wind market.

-

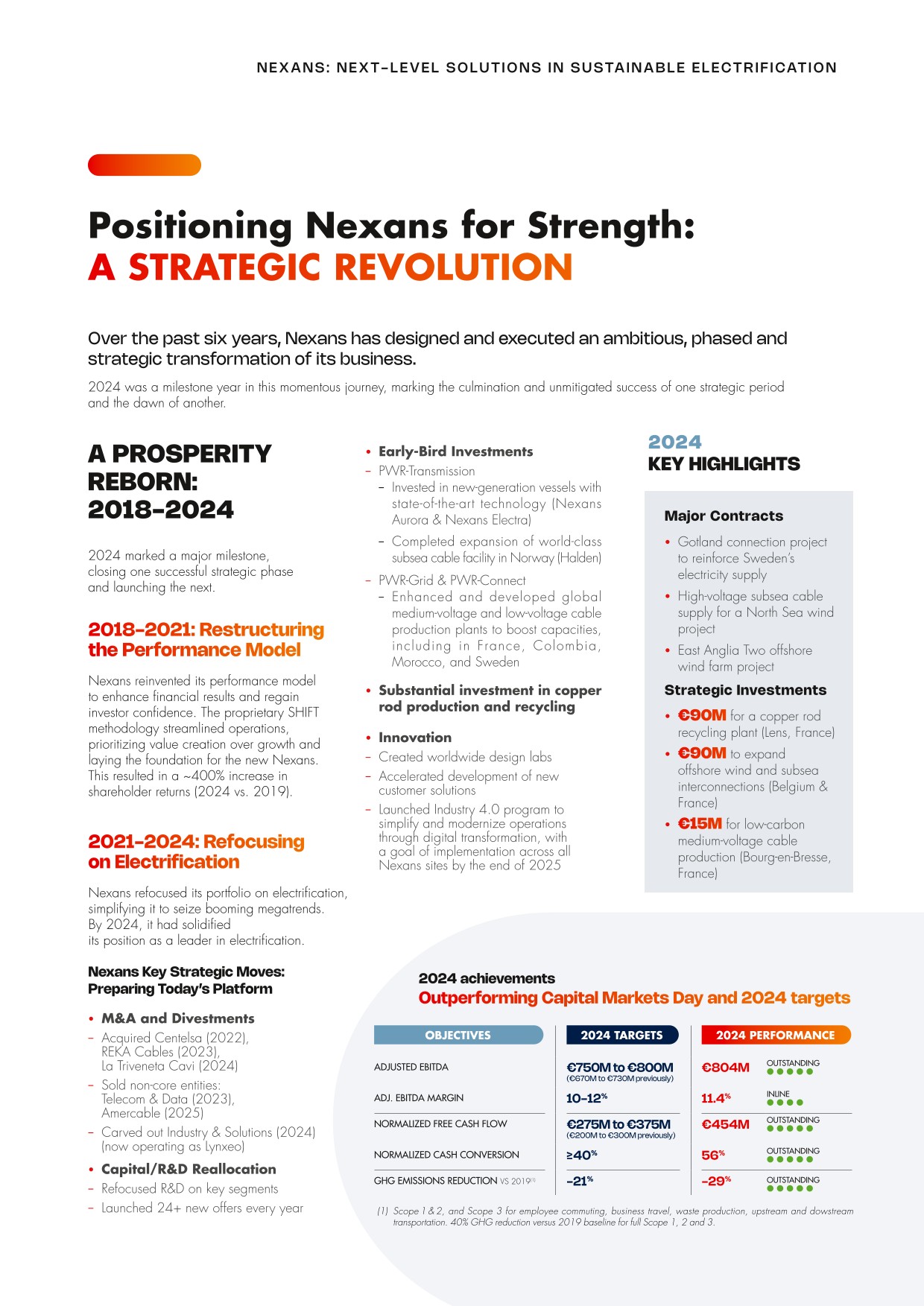

1.6Group operations during 2024

1.6.1Consolidated results of the Group

1.6.1.1Overview

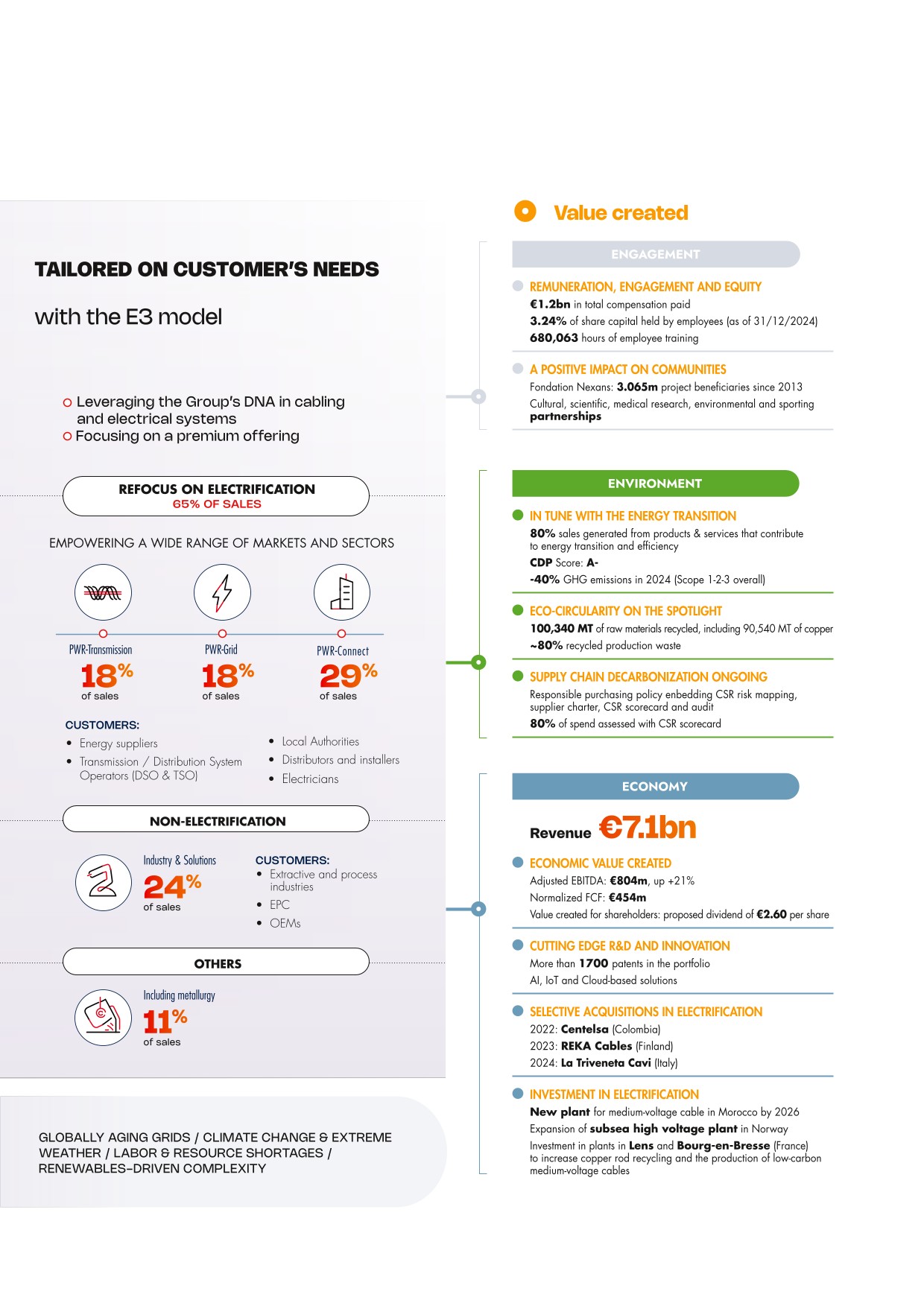

In 2024, sales at standard metal prices reached €7,078 million, demonstrating strong organic growth of +5.1% at constant scope and currency compared to 2023. Excluding the Other activities segment, which is being strategically scaled down, organic growth stood at +8.1%. The Electrification businesses grew by +13.0% organically, driven largely by the PWR-Transmission segment's strong growth thanks to capacity expansion at the Halden plant in Norway. After a double digit organic growth in 2023, the Non-electrification business proved resilient with a small organic decline of -2.5%.

Net acquisitions/disposals had an impact on standard sales of +€219 million reflecting i) the integration of La Triveneta Cavi into the PWR-Connect segment from June 1, 2024, ii) the acquisition of Reka Cables since April 2023 bolstering PWR-Grid and PWR-Connect segments, and iii) the divestment of the Telecom business since October 2023 in line with Nexans’ vision to become an Electrification Pure Player.

Adjusted EBITDA reached a record high of €804 million in 2024, up by a solid +21.0% versus €665 million in 2023. This strong performance underscored the profitability enhancements across all business segments. The adjusted EBITDA margin reached an all-time high of 11.4%, surpassing the previous year's strong performance of 10.2%. This achievement illustrates the Group’s strategic focus on operational excellence, selectivity and value-driven growth. Electrification businesses achieved 12.9% adjusted EBITDA margin, outperforming the 2023 achievement of a 12.5% margin.

In 2024, specific operating items amounted to a negative €22 million. They included €19 million related to share-based payment expenses, and €3 million related to additional costs on long-term projects impacted by past reorganizations.

EBITDA including share-based payment expenses – as per the 2021 Capital Markets Day definition – amounted to €785 million in 2024, versus €652 million in 2023. The Group’s EBITDA margin stood at 11.1% in 2024, in line with the Group’s 2021 Capital markets day target of 10%-12%.

ROCE (including the 12-month contribution of La Triveneta Cavi and AmerCable) pursued its strong trajectory, reaching 21.1% for the Group, and 26.3% for the Electrification businesses.

Operating margin totaled €566 million in 2024, representing 8.0% of sales at standard metal prices (versus 6.6% in 2023).

1.6.1.2Detailed analysis by segment

PWR-TRANSMISSION

PWR-Transmission standard sales came in at €1,287 million in 2024, up +50.3% organically compared to 2023, boosted by the completion of the Halden, Norway, plant capacity expansion at the beginning of the year, which doubled XLPE technology capacities. In the fourth quarter of 2024, Nexans achieved organic growth of +41.9% compared to the fourth quarter of 2023.

The segment’s adjusted EBITDA reached €142 million in 2024, up +72.3% compared to the same period last year. The adjusted EBITDA margin showcased a significant increase to 11.0% in 2024, versus 9.5% in 2023. As expected, the margin upturn throughout the year was supported notably by Revolution Wind successful installation campaign, Inspection Maintenance and Repair (IMR) projects as well as continued execution of the Great Sea Interconnector project.

Customer activity remained dynamic, and in line with the Group’s risk-reward selectivity approach, the segment’s adjusted backlog reached €7.4 billion at December 31, 2024, up +21.4% compared to December 31, 2023. The strong order intake was notably fueled by a substantial contract for the Gotland electricity connection project, an important contract for East Anglia TWO offshore wind project in the southern North Sea, and the LanWin 2 final award as part of the frame-agreement with TenneT for around €1 billion. This record-high adjusted backlog is more than 90% subsea-driven (subsea interconnection and offshore wind projects) and provides multi-year visibility with around 90% of the topline of the business secured for the 2024-2028 period.

The robust visibility of manufacturing and installation asset loads has been extended through 2030, with both Charleston and Halden plants more than 90% loaded up to 2028. Construction of Nexans’ third cable-laying vessel, Nexans Electra, is on-track and will be completed in 2026. This state-of-the-art vessel is a strategic asset that will significantly enhance capacity to address the substantial growth in the business’ backlog. The Group also unveiled a strategic €90 million investment at its facilities in France and Belgium to increase the production of advanced 525kV onshore cables meeting the requirements of the TenneT frame agreement.

PWR-GRID

Standard sales in the PWR-Grid segment rose organically by +3.1% compared with 2023 to €1,243 million. Fourth quarter 2024, saw strong organic sales growth of +7.6% compared to the same quarter last year. Europe benefited from increased demand and the securing of new frame-agreements. The Middle East and Africa region was boosted by renewable energy projects. North America was stable with a good second half, while South America encountered some project delays. The Accessories business was a solid contributor throughout the year.

Adjusted EBITDA rose by a sharp +9.0% year-on-year to €170 million supported by selectivity on new frame-agreements, operational excellence and the contribution of the Reka Cables acquisition completed in April 2023. The adjusted EBITDA margin reached an unprecedented 13.6% in 2024 compared with 13.2% in 2023, reflecting selective growth and successful business transformation.

PWR-CONNECT

Standard sales in the PWR-Connect segment amounted to €2,073 million in 2024, up +1.4% organically. Europe suffered from lower demand in some residential markets, despite sustained momentum in commercial and infrastructure segments. Near East & Africa and South America remained very strong while North America (Canada) rebounded in the second half of the year. In fourth-quarter 2024, Nexans achieved organic growth of +4.2% compared to fourth quarter 2023 and +0.5% compared to the third quarter of 2024.

The 2024 figures reflect the contributions of La Triveneta Cavi, starting from June 1, 2024, and Reka Cables, since April 2023. These acquisitions are integral to Nexans' Electrification strategy, expanding the Group’s capabilities and reinforcing its market position in key regions.

Adjusted EBITDA reached €283 million in 2024, up +23.8% year-on-year. Adjusted EBITDA margin was a robust 13.7%, thanks to structural performance improvement initiatives, selectivity and value-added solutions.

NON-ELECTRIFICATION (Industry & Solutions)

In the Industry & Solutions segment, standard sales for 2024 amounted to €1,701 million, reflecting a low organic decrease of -2.5% year-on-year, while fourth-quarter 2024, up +2.1% compared to fourth-quarter 2023.

The performance reflects a slowdown in the Automation market in Europe, which was partially offset by a stable Shipbuilding, Rollingstock and Nuclear business. The Auto-harnesses business was stable during the year.

Adjusted EBITDA for the segment increased by +11.9% and reached €207 million, resulting in an adjusted EBITDA margin of 12.2% in 2024, compared to 10.6% the previous year. This improvement reflected a positive mix and pricing effect resulting from the successful transformation of the business.

Other Activities

The Other activities segment – corresponding for the most part to copper wire sales and corporate costs that cannot be allocated to other segments – reported standard sales of €774 million in 2024. Standard sales were down -14.4% organically year-on-year, mainly linked to the Group’s strategy to reduce copper wire external sales through tolling agreements in order to mitigate their dilutive effect.

-

1.7Other relevant information on Group activities

1.7.1Investments

The Group’s tangible and intangible capital expenditure came to 378 million euros in 2024 compared to 377 million euros in 2023.

- ●Strategic CAPEX in the PWR-Transmission segment encompassing mainly the expansion of the Halden high-voltage cable plant in Norway, addition of capabilities at the Charleston plant in the United States and Nexans Electra new cable laying vessel. In 2024 Strategic CAPEX amounted to 202 million euros, versus 199 million euros in 2023;

- ●Nexans’ World Class manufacturing program to improve sites’ industrial performance, digital transformation and Industry 4.0 has been speed up – more than 30 sites are using digital management routines and 10 sites have deployed a manufacturing execution system (MES);

- ●the decarbonization of the Group’s own operations, by investing progressively in energy efficiency, site electrification, renewable energies, and electrical vehicles. In 2024, these investments amounted to around 5 million euros;

- ●the evolution of the Group’s products and solutions.

-

1.8Information on the Nexans Group and company

1.8.1General information about the Group

1.8.1.1Company identity

The Company is registered in the Nanterre Trade and Companies Register under number 393 525 852. Its APE code is 7010Z.

The Legal Entity Identifier (unique identifier of financial market participants) of Nexans is: 96950015FU78G84UIV14.

1.8.1.2Legal form and applicable legislation

Public limited company under French law, subject to all the texts governing commercial companies in France, and in particular to the provisions of the French Commercial Code.

1.8.1.3Documents accessible to the public

The Company’s Bylaws, its parent company and consolidated financial statements, the reports presented to its Meetings by the Board of Directors and the Statutory Auditors, as well as the Internal Regulations of the Board of Directors and the Code of Ethics and Business Conduct and all other corporate documents may be consulted by shareholders in accordance with the legal and regulatory provisions in force. They are available for consultation at the Company’s registered office and on the website: www.nexans.com, which contains regulated information published in accordance with Articles 221-1 et seq. of the General Regulations of the AMF.

1.8.1.4Date of incorporation and term

The Company was incorporated on January 5, 1994, under the corporate name “Atalec” (replaced by “Nexans” at the Shareholders’ Meeting of October 17, 2000), for a period of 99 years, until January 7, 2093. Nexans results the consolidation of most of the cable activities of Alcatel, which is no longer a shareholder of Nexans, and was listed on the stock exchange in 2001 (for more information on the history of the Company, see section 1.1 of this Universal Registration Document).

1.8.1.5Corporate purpose (summary of Article 2 of the Bylaws)

In all countries, study, manufacture, operation and trade all apparatus, hardware and software relating to domestic, industrial, civil or military and other applications of electricity, telecommunications, data processing, electronics, space industry, nuclear energy, metallurgy and, in general, any means of production or transmission of energy or communications (cables, batteries and other components), as well as, in the alternative, all activities relating to operations and services relating to the means referred to above. The acquisition of stakes in all companies, whatever their form, associations, French or foreign groups regardless of their corporate purpose and activity; and, in general, all operations industrial, commercial, financial, movable and immovable relating, directly or indirectly, in whole or in part, to any of the objects indicated in the statutes and to any similar or related objects.

1.8.1.6Fiscal year

-

2.1Risk factors

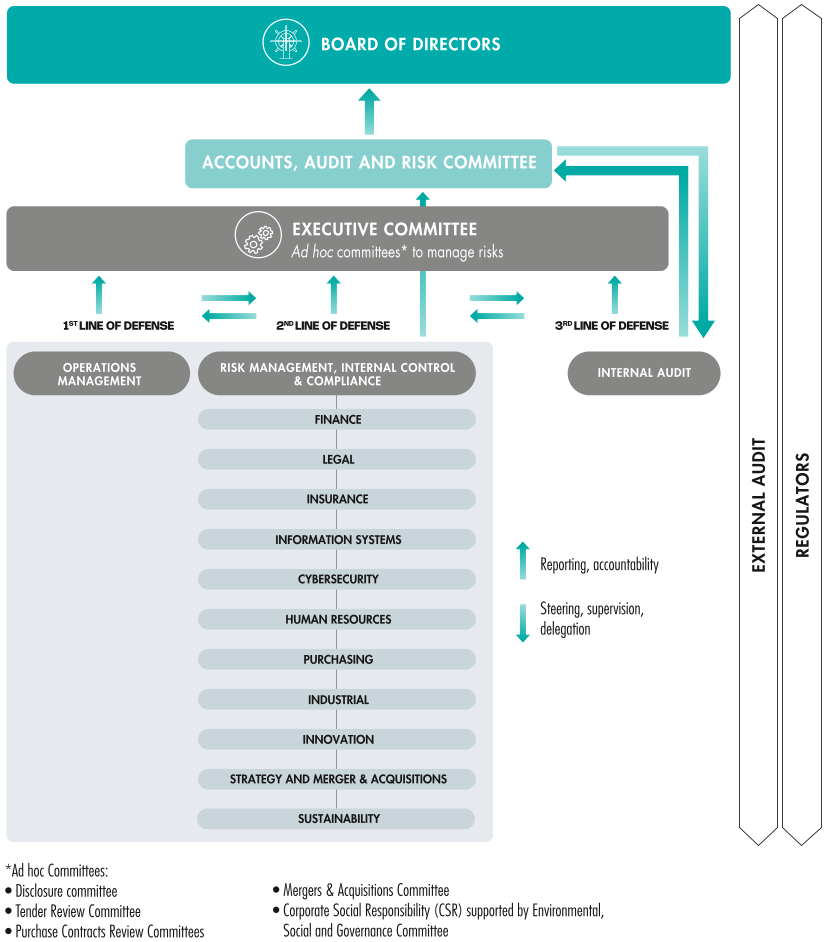

In an ever-evolving environment, Nexans is dedicated to protecting the safety and health as well as the interests of its employees, the interests of its shareholders, clients, suppliers, and all of its stakeholders, while achieving its objectives. To navigate this landscape, Nexans has implemented a proactive risk management policy to efficiently respond to any internal and external threats likely to affect its finance, operations, reputation or future prospects. Given Nexans’ global presence, the competitive nature of the cable industry and the diversity of its businesses, Nexans faced a variety of risks, both endogenous and exogenous. Nexans diligently manages Strategic, Operational, Legal and Compliance, and Financial risks to not only minimize their occurrence but also to mitigate their potential impact. To achieve this, the Group has established and consistently enhances its risk management processes and organization.

As part of Nexans’ risk management process, the Group has conducted an assessment to identify the primary risk factors it faces.

Pursuant to the provisions of Article16 of Regulation (EU) 2017/1129 of the European Parliament and of the Council, this chapter outlines the main specific risks that could, on the date of this Universal Registration Document, impact the Group’s business, financial condition, outlook reputation, operational results or ability to achieve its objectives. The 15 risks are clustered in four categories (Strategic Risks, Operational Risks, Legal and Compliance Risks, and Financial Risks). These 15 risks are, however, not exhaustive and other risks or uncertainties, whether unknown or not considered herein at the date of this Universal Registration Document, could occur or arise and have a material adverse effect on the Group.

Methodology

In term of methodology, the 15 identified risks are those which are specifically pertinent to Nexans and have the most significant net impact.

Led by the Group Risks Department, the management of Nexans' business groups and main functional departments have assessed in 2024 among Nexans' environment of risks, the risks that could have a material impact on the Group’s operations or performance, including the main ESG issues.

The ranking of the net score of each risk is based on the assessment of i) the highest level of criticality (potential impact on the Group multiplied by probability of occurrence), and ii) the effectiveness of the risk mitigation measures deployed by the Group to detect, prevent and/or mitigate their impact and frequency of occurrence of the said risk. The risks are ordered by their level of importance, and within each category, those with the greatest residual exposure are presented first. The Group classifies the residual risks on a scale ranging from “low”, “moderate”, “material” to “critical”.

-

2.2Insurance

Nexans Insurance Department is in charge of subscribing, negotiating and deploying insurance programs throughout the Group. It seeks the best coverage available in the insurance market at an optimum price for its specific exposures with highly reputed insurance companies with strong financial ratings.

The Group’s insurance policies cover current identified risks while taking into account new acquisitions or disposals that may occur during the year. Working closely with international brokers, the Insurance Department always seeks to optimize costs while ensuring adequate coverage based among other criteria on regular risk assessments, Group’s claims experience, advice from brokers with industry benchmarks as well as specific risks and/or actuarial studies. On a regular basis, the Insurance Department launches insurer and broker bids.

The overall cost of insurance policies (excluding life & health and accident insurance) taken out at Group level represents less than 0.5% of consolidated sales at constant non-ferrous metal prices.

To contain insurance premiums and secure coverage, Nexans reinforces the use of its reinsurance captive in the insurance structures and is permanently studying the opportunity to add new risks. Finally, the Group regularly reassesses its risk appetite to counter any negative impact of the insurance market.

Apart from the directors and officers liability policy, the main insurance programs taken out by the Group are as follows:

Property damage – business interruption

The property damage insurance program covers Nexans assets worldwide and consequential interruption of business in the case of a loss.

-

2.3Risk management within the Group

The main items of Nexans’ risks management and internal control system are described in the chart below and are based on three defense lines.

2.3.1Three lines of defense

First Line of defense – Business Groups and operating entities

The Business Groups and operating entities play a front-line role in managing risks in their respective geographic and business areas.

Their departments are responsible for applying all of the Group Management Procedures in their areas of responsibility, covering compliance with applicable laws and regulations and with the Group’s Code of Ethics and Business Conduct and Management of Incident reports.

Second Line of Defense – Risk Management, Internal Control and Compliance

Coordinated by the Departments of Risk Management, Internal Control and Compliance together with the functional departments in their fields of expertise, the second line of defense aims at designing and piloting a system of control of the Group activities, in particular by:

- ●assisting operating units in the identification and assessment of the main risks within their scope of expertise;

- ●designing Group policies and procedures by area of activity;

- ●contributing, with operating units, in designing adapted controls systems or mechanisms;

- ●raising awareness on risk management, internal control and compliance by communicating on best practices and training operating employees.

Third Line of defense – Internal Audit

Internal Audit Department is to provide Nexans’ Board of Directors and Executive Committee with reasonable assurance on the robustness of the system of risk management, internal control and compliance management of the Group in realizing audits of functions and business units on the deployment of risk management, internal control system and compliance management as well as related procedures.

-

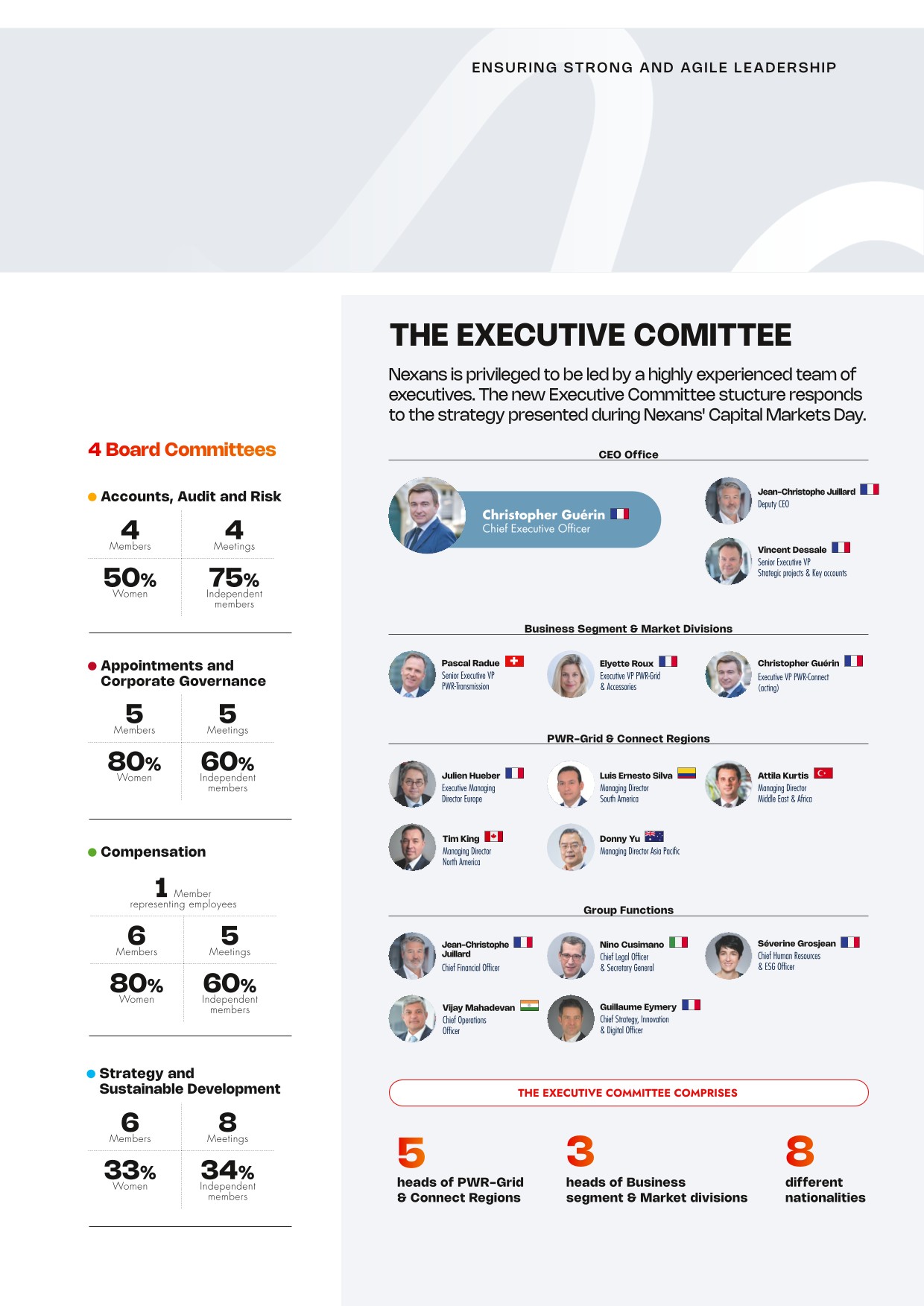

4. Corporate governance

The Board of Directors’ report on corporate governance was reviewed by the Appointments and Corporate Governance Committee and the Compensation Committee on February 10, 2025. It was approved by the Board of Directors on February 18, 2025, in accordance with the requirements of Article L.225-37 of the French Commercial Code. This report is included in this chapter.

-

4.1Corporate Governance Code

The Company refers to the Corporate Governance Code for listed companies published by the Association Française des Entreprises Privées (AFEP and the Mouvement des Entreprises de France (MEDEF, as amended in December 2022. The AFEP-MEDEF Code is available on the MEDEF website, www.medef.com, and the AFEP website, www.afep.com.

-

4.2Governance structure

Separating the duties of Chairman of the Board and Chief Executive Officer (CEO)

On May 15, 2014, on the recommendation of its Chairman, the Board of Directors approved the principle of separating the duties of Chairman of the Board and Chief Executive Officer (CEO).

This organization allows the Company and Executive Management to concentrate on its strategic priorities and implement the strategic plan under the best possible conditions. It is carried out in conjunction with the Group’s transformation. It also helps ensure that the Board of Directors operates better. The interest of this separation of duties has been confirmed by the Board assessments carried out each year since 2014.

-

4.3Management bodies

4.3.1Chief Executive Officer (CEO)

Christopher Guérin

Chief Executive Officer (CEO) since July 4, 2018

Number of shares held: 59,653

Number of corporate mutual fund units invested in Nexans shares: 1,152

Age: 52

Nationality: French

Address: 4 allée de l’Arche, 92400 Courbevoie, France

Expertise/Experience

Christopher Guérin is Chief Exectuive Officer of Nexans (CEO) since July 4th, 2018. Since taking up the position of CEO, he has made a major strategic shift to reposition the Group on the world's sustainable electrification markets. This transformation is based on the E3 management model, balancing business performance with environmental protection and employee engagement. In this way, Nexans has placed climate issues at the very heart of its strategy, driving a more rational approach to growth, while significantly improving the company's profitability. Christopher began his management career with the Linde Group in the UK, before moving in 1997 to Alcatel Câbles, which became Nexans in 2001. He held a number of management positions in the Metallurgy Division. Between 2005 and 2007, Christopher was Sales Director for Europe. From 2007 to 2013, he held various sales and marketing positions in France and then in Europe. From 2013 to 2018, he managed the industry market line. From 2014 to 2018, he was Senior Vice-President for Europe and the Telecommunications, Data and Power Connection Systems Groups at Nexans.

Christopher Guérin is a graduate of ESDE/American Business School. He also followed INSEAD’s Management Acceleration program.

Directorships and other positions held during the 2024 fiscal year (and still in force at the 2024 year-end)

- –Chairman of Europacable*

- –Vice-Chairman of ICF*

Directorships that have expired in the last five years

- –None

* Positions held in foreign companies or institutions.

-

4.4Administrative body

4.4.1Board of Directors’ composition and diversity policy

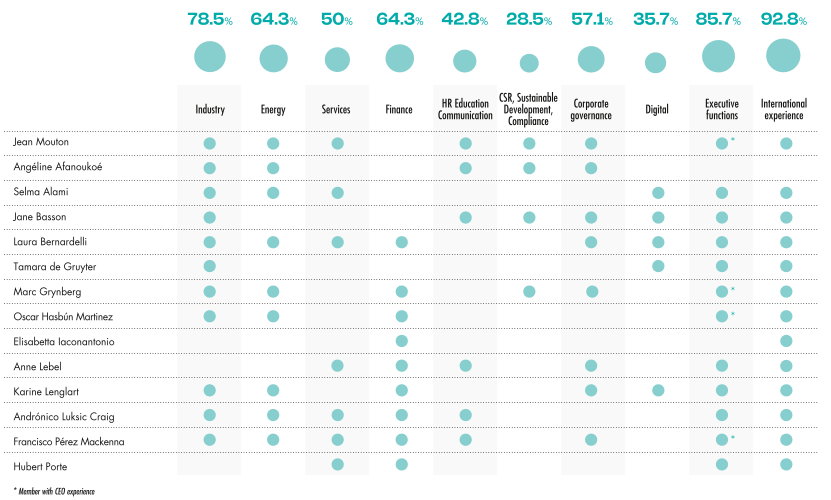

4.4.1.1Composition of the Board, the Committees and the diversity policy

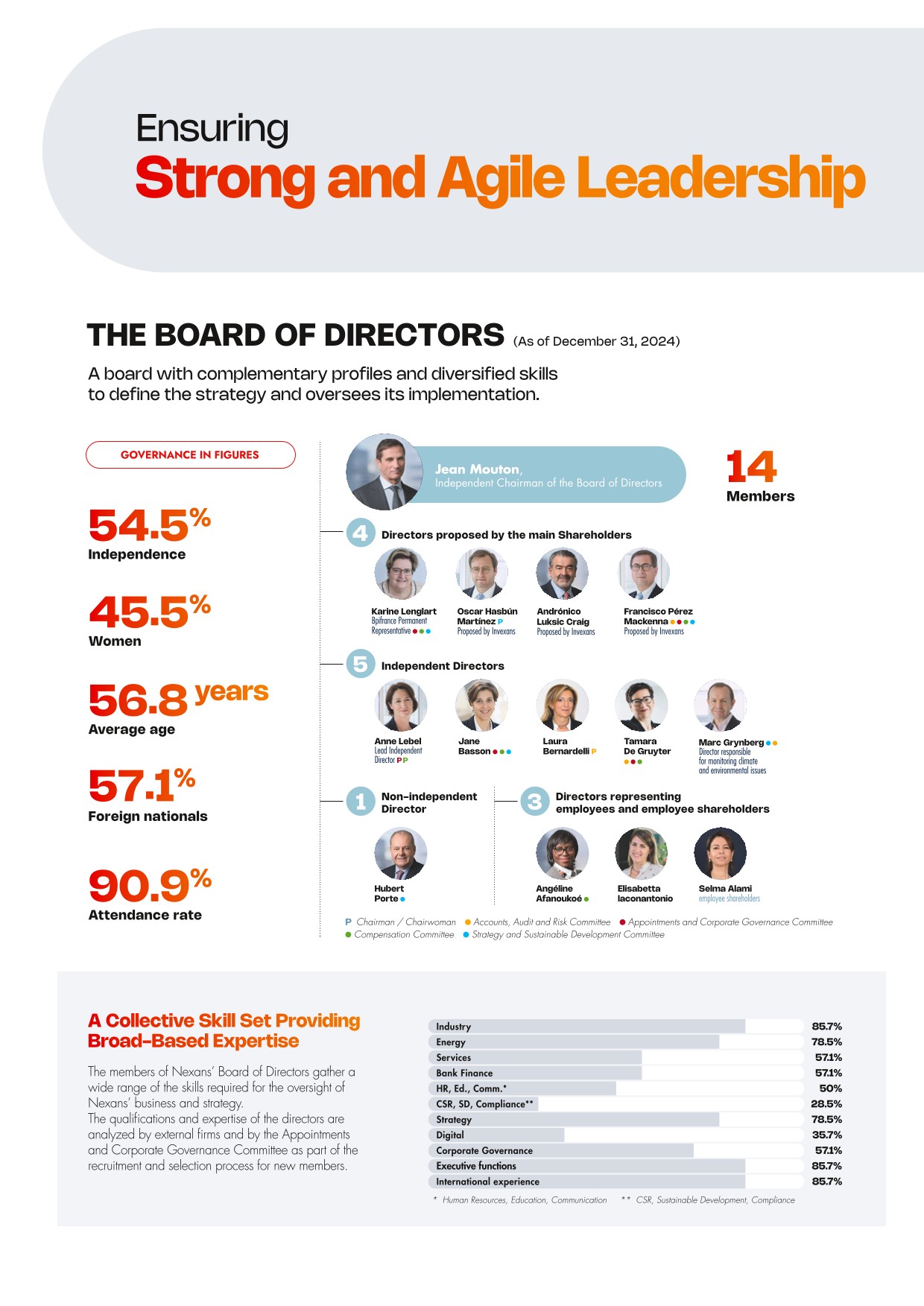

In accordance with Article 11 of the Company’s Bylaws, the Board of Directors may include between 3 and 18 members at the most. At December 31, 2024, the Board of Directors included 14 directors.

In accordance with Recommendation 7.2 of the AFEP-MEDEF Code, at its meeting of February 18, 2025, the Board discussed the balance reflected in its composition and that of its Committees, notably in terms of diversity. The Board of Directors aims to boost diversity and complementary skills and maintain a diverse profile in terms of age, nationality, international experience and gender balance. The Board of Directors is also attentive to maintaining a balanced distribution between directors with historical knowledge of the Company and directors who have joined the Board more recently.

Pursuant to Article L.22-10-10 of the French Commercial Code, the following table sets out the diversity policy applied within the Board of Directors and indicates the criteria used, the objectives set down by the Board of Directors, the implementation procedures and the results obtained over the fiscal year ended December 31, 2024.

Criteria

Objectives

Procedures implemented and results obtained in 2024

Size of the Board

Maintaining the number of directors at between 12 and 16.

Given the breakdown of its share capital and the fact that three directors of the principal shareholder Invexans Limited (Quiñenco Group) and the shareholder Bpifrance Participations sit on its Board of Directors, the latter considered 14 directors at the end of 2024 to be a satisfactory number.

Age and seniority of directors

Less than one third of directors should be over 70 years of age.

In addition to the age of the directors, seeking a balanced distribution in terms of seniority on the Board.

At December 31, 2024, the ages of the directors ranged from 42 to 70 years and the average age of the directors was 56.8 years.

One director is over 70 years old.

The Board considers that its composition is balanced, with directors having historical knowledge of the Group and directors who have joined the Board more recently. The length of service for directors ranges from 1 to 14 years, with an average of 6.8.

Gender

Maintaining a balanced representation between men and women with at least 40% of women.

The proportion of women(a) on the Board at December 31, 2024, was 45.5%.

Nationalities

Over 25% of directors are foreign nationals.

Eight directors are foreign nationals. As such, 57.1% of the directors were foreign nationals at December 31, 2024.

Independence

The Board set itself the objective of maintaining an independence rate of at least 50% in accordance with Recommendation 10.3 of the AFEP-MEDEF Code.

The independence rate was over 54.5%(b) at December 31, 2024. Concerning the characterization of directors’ independence, see Section 4.4.1.3 of this Universal Registration Document.

Expertise/experiences

Seeking out complementary expertise in industry, energy, finance, communications, CSR, compliance, human resources and services, as well as extensive knowledge of the Nexans Group and its stakeholders, and rounded out by senior executive experience.

Of the Board of Directors’ members, at least:

- ●10 have a career in industry;

- ●2 have a career in energy;

- ●4 have a career in finance, banking or private equity;

- ●3 have a career in human resources, education, talent management;

- ●2 have a career in communications;

- ●2 have a career in services;

- ●3 work within the Nexans Group;

- ●11 have exercised senior management functions.

Representation of stakeholders

Ensuring balanced representation of the different stakeholders.

Three directors were appointed based on a proposal submitted by the principal shareholder, Invexans Limited (Quiñenco Group).

The shareholder Bpifrance Participations has been appointed as director.

Pursuant to Article 12 bis of the Bylaws, one of the Board members is appointed at the Ordinary Shareholders’ Meeting, from among the two candidates proposed by the employee shareholders.

Pursuant to Article 12 ter of the Bylaws, two directors representing employees are appointed by the French Works Council and the European Group Works Council.

- (a)Proportion of women on the Board calculated without counting the directors representing employees and employee shareholders, in accordance with paragraph 2 of Article L.22-10-6 of the French Commercial Code. This rate would be 50% when taking into account the employee shareholder representative.

- (a)Independence rate calculated without counting the directors representing employees and employee shareholders in accordance with Recommendation 10.3 of the AFEP-MEDEF Code.

Summary table of the composition of the Board of Directors and its Committees

The following table summarizes the composition of the Board of Directors and the Committees at December 31, 2024.

Personal information

Position on the Board

Participation in a Committee

Surname and name, corporate name

Age

Woman/

Man

(W/M)Nationality

Number of shares held

Start of first term of office

End of current term of office

Length of service on the Board (number of years)

Inde-

pendenceAccounts, Audit and Risk Committee

Appointments and Corporate Governance Committee

Compensation Committee

Strategy and Sustainable Development Committee

Chairman

Mouton Jean

68

M

9,994

05/15/2019

2027 AGM

6

Yes

Directors proposed by the main shareholders

Bpifrance, represented by Karine Lenglart

52

W

2,273,546

05/15/2019

2027 AGM

6

No

✓

✓

✓

Hasbún Martínez Oscar

55

M

500

05/15/2019

2027 AGM

6

No

C

Luksic Craig Andrónico

70

M

6,740

05/14/2013

2025 AGM

12

No

Pérez Mackenna Francisco

66

M

500

05/31/2011

2025 AGM

14

No

✓

✓

✓

✓

Independent directors

Lebel Anne Lead Independent Director

59

W

500

05/17/2018

2026 AGM

7

Yes

C

C

Basson Jane

55

W

500

05/13/2020

2028 AGM

5

Yes

✓

✓

✓

Bernardelli Laura

55

W

510

05/11/2021

2026 AGM

3

Yes

C

Grynberg Marc, director responsible for monitoring climate and environmental issues

59

M

2,000

05/11/2017

2025 AGM

8

Yes

✓

✓

Tamara de Gruyter

52

W

35

05/16/2024

2028 AGM

1

Yes

✓

✓

✓

Porte Hubert

60

M

571

11/10/2011

2027 AGM

14

No

✓

Directors representing employees and employee shareholders

Afanoukoé Angéline

54

W

520

10/11/2017

2025 AGM

8

No

✓

Alami Selma

49

W

734

05/12/2021

2025 AGM

4

No

Iaconantonio Elisabetta

42

W

0

05/16/2024

2028 AGM

1

No

Skills and qualifications matrix of the members of Nexans' Board of Directors

As a group, the members of Nexans’ Board of Directors have a wide range of the skills required for the Group’s businesses. These skills range from significant industry and global markets expertise, for many of them, to executive management roles, and functional areas such as human resources, compliance, finance and communication. The qualifications and expertise of the directors are analyzed by external firms and the Appointments and Corporate Governance Committee at the time of their recruitment as part of the selection process for new members. The results are presented in a skills matrix below.

Industry: Professional experience acquired within a French or foreign industrial group, or as an external consultant, in institutions, professional organizations or in the exercise of a corporate mandate.

Energy: Professional experience in one or more energy fields, acquired within a French or foreign industrial group, or as an external consultant, in institutions, professional organizations or in the exercise of a corporate mandate.

Services: Experience in a digital services company, software company, consulting firm, or business services.

Finance: Expertise in the field of private equity or corporate finance, including in-depth knowledge of financial reporting processes, risk management, audit or internal control, accounting, treasury, taxation, mergers and acquisitions, and financial market mechanisms.

Human Resources - Education - Communication: Degree and/or professional experience acquired in the field of Human Resources, Training or Communication, in companies or as an external consultant, in institutions, professional organizations or as part of the exercise of a corporate mandate.

CSR - Sustainable Development - Compliance: Experience in the management of environmental and societal issues and CSR governance as well as in the management of compliance programs.

Corporate governance: Experience as a member of a corporate governance committee in a listed company, knowledge of corporate governance through training courses, membership of the Institut Français des Administrateurs.

Digital: Direct technical or managerial expertise or experience in the development and implementation of technology and/or digital strategies, digitization and innovative technologies in relevant sectors.

Executive functions: Experience as Chief Executive Officer (CEO), member of the Executive Committee or senior executive in a large entity or in a large international group.

International experience: Directors with in-depth knowledge of foreign markets and having been directly responsible for them.

Length of directors' term of office

Pursuant to Article 12 of the Bylaws, the term of office of directors is four years. At December 31, 2024, the terms of office of the directors appointed by the Shareholders’ Meeting expire as follows:

2025 AGM

Selma Alami(b), Marc Grynberg, Andrónico Luksic Craig(a), Francisco Pérez Mackenna(a)

2026 AGM

Laura Bernardelli, Anne Lebel

2027 AGM

Jean Mouton, Bpifrance Participations represented by Karine Lenglart, Oscar Hasbún Martínez(a), Hubert Porte

2028 AGM

Jane Basson, Tamara de Gruyter

- (a)Directors proposed by the main shareholder Invexans Limited (Quiñenco Group).

- (b)Director representing employee shareholders.

Changes that occurred in the composition of the Board of Directors and the Committees during the 2024 fiscal year

The summary table below lists the changes that occurred in the composition of the Board of Directors and the Committees during the 2024 fiscal year:

Date of event

Person concerned

Change

March 20, 2024

Tamara de Gruyter

Appointment as a Censor

May 16, 2024

Jane Basson

Renewal of the term of office as Director and member of the Appointments and Corporate Governance Committee, the Compensation Committee and the Strategy and Sustainable Development Committee

May 16, 2024

Sylvie Jéhanno

End of the term of office as Director and member of the Accounts, Audit and Risk Committee, the Appointments and Corporate Governance Committee and the Compensation Committee

May 16, 2024

Tamara de Gruyter

Appointment as Director and member of the Accounts, Audit and Risk Committee, the Appointments and Corporate Governance Committee and the Compensation Committee

May 16, 2024

Bjørn Erik Nyborg

End of the term of office as director representing employees

May 16, 2024

Elisabetta Iaconantonio

Appointment as Director representing employees by the European Works Council

Changes that occurred in the composition of the Board of Directors and the Committees since December 31, 2024

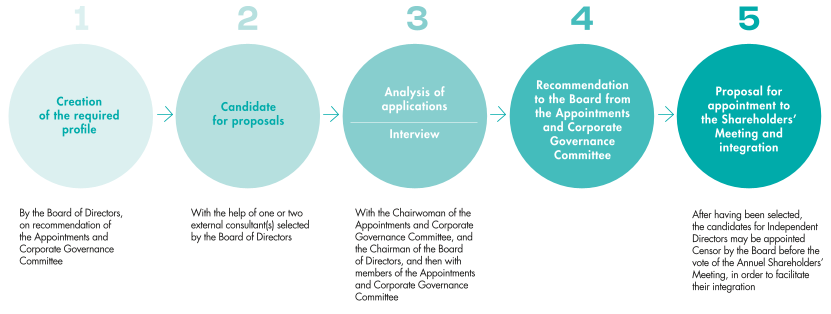

Identification and selection process for new independent directors

The appointment of Directors is subject to a transparent selection process before being submitted to shareholders for approval at the Shareholders’ Meeting. The purpose of this selection process is to determine the profile of Directors that the Company needs in terms of skills, qualifications and experience, in order to enrich those already present on the Board of Directors.

Particular attention is paid to availability, multiple offices in other companies and the independence of the Directors. At the beginning of 2025, the Appointments and Corporate Governance Committee analyzed the participation of each member of the Board of Directors in the meetings of the Board and the Committees during 2024, as well as the offices held by each of them as of December 31, 2024, in all French or foreign companies, listed or not.

As part of the process for identifying and selecting new independent directors, the Appointments and Corporate Governance Committee avails itself of one or several independent headhunting firms to help with the selection of candidates to be submitted to the Board of Directors. This selection is based on criteria drawn up by the Board of Directors at the proposal of the Appointments and Corporate Governance Committee, in line with the Board of Directors’ diversity policy and the results of its previous annual assessments.

The Chairwoman of the Appointments and Corporate Governance Committee and the Chairman of the Board of Directors meet with the candidates shortlisted by the Committee and present the various applications to the Committee. The Committee then makes its recommendation to the Board of Directors, which makes the final decision.

The Board of Directors’ Internal Regulations, which are available in full on the Company’s website, include a description of this process.

Selection process for Directors REPRESENTING A SHAREHOLDER OR PROPOSED BY A SHAREHOLDER

When a director represents a shareholder or is proposed by a shareholder, the profile sought is determined by the shareholder taking into consideration the objectives set by the Board of Directors, on the proposal of the Appointments and Corporate Governance Committee. The candidate is selected by the shareholder concerned and is then presented to the Chairman of the Board of Directors, the Chairwoman of the Appointments and Corporate Governance Committee and the Chief Executive Officer (CEO). The Appointments and Corporate Governance Committee then examines the application and interviews the proposed candidate before issuing a recommendation to the Board of Directors.

The Internal Regulations of the Board of Directors include a specific procedure applicable to the appointment of the permanent representative of a legal entity director.

4.4.1.2Members of the Board of Directors

Jean Mouton

Chairman of the Board of Directors

First elected as a director: May 15, 2019

Appointed as Chairman of the Board of Directors: May 15, 2019

Expiration of current term as director: 2027 AGM

Number of shares held: 9,994

Age: 68

Nationality: French

Address: 4 allée de l’Arche, 92400 Courbevoie, France

Expertise/Experience

Jean Mouton was Senior Partner and Managing Director of the Boston Consulting Group (BCG) until April 30, 2019, and then Senior Advisor until April 30, 2020. Since joining the BCG in 1982, Jean has worked extensively, primarily in France and Italy, in a wide range of industrial sectors, including energy, industrial goods and infrastructure. He has partnered with global companies to redefine their strategies and organization and has supported numerous clients through mergers and acquisitions. Prior to joining BCG, Jean worked for Vinci in the Middle East. He is a member of the Supervisory Board of Aéroports de la Côte d’Azur (ACA). Jean Mouton is also a director of Getlink and of Egis, an international player in consulting, construction engineering and mobility services. He is also the Chairman of Stelmax SASU. Jean is a graduate engineer from the École Supérieure des Travaux Publics and holds an MBA from the University of Chicago.

Directorships and other positions held during the 2024 fiscal year (and still in force at the 2024 year-end)

- –Member of the Supervisory Board of ACA (Aéroports de la Côte d’Azur)

- –Member of the Board of Directors of Getlink and Egis

- –Chairman of Stelmax SASU

Directorships that have expired in the last five years

- –Senior Partner and Managing Director of the Boston Consulting Group

- –Member of the Board of Directors of Atlantia S.p.A.* (now Mundys S.p.A.*)

Positions held in listed French or foreign companies.

* Positions held in foreign companies or institutions.

Angéline Afanoukoé

Director representing employees

Head of Employer Brand and Educational Partnerships at Nexans

First elected as a director: October 11, 2017

Expiration of current term as director: 2025 AGM

Member of the Compensation Committee

Number of shares held: 520

Number of corporate mutual fund units invested in Nexans shares: 95

Age: 54

Nationality: French

Address: 4 allée de l’Arche, 92400 Courbevoie, France

Expertise/Experience

Angéline Afanoukoé is Nexans' Head of Global Employer Brand and Educational Partnerships having been Nexans Head of Institution Relations from 2020 to 2023 and the Head of External Affairs between 2017 and 2019. In her current role, Angéline is responsible for talent acquisition, employer branding and partnership strategies in the field of education. She is also responsible for the dissemination and promotion of Nexans Foundation projects while strengthening employee engagement in this area.

Previously, she was responsible for improving the Group’s visibility and enhancing the brand image with Nexans stakeholders by managing the institutional communication and sponsorship activities on a global scale and was in charge of communication with individual shareholders and employees in the Investor Relations Department from 2001, before taking on responsibility for the Group’s press relations in 2012. Angéline joined the financial department of the Metallurgy Division of Alcatel Câbles and Components in 1998. She started her career in 1991, working in small and medium-sized companies in the sales and events sector.

Angéline holds a Master’s in International Business from University Paris V René Descartes as well as a Certified European Financial Analyst (CEFA) certificate from Société Française des Analystes Financiers (SFAF). She is also certified as a Company Director by Sciences-Po and the French Institute of Administrators (Institut Français des Administrateurs - IFA) and holds the ESG Analyst Certificate from the European Federation of Financial Analysts Societies (EFFAS).

Directorships and other positions held during the 2024 fiscal year (and still in force at the 2024 year-end)

- –None

Directorships that have expired in the last five years

- –None

Selma Alami

Director representing employee shareholders

General Manager of the North West Africa Usages Business Unit

First elected as a director: May 12, 2021

Expiration of current term as director: 2025 AGM

Number of shares held: 734

Number of corporate mutual fund units invested in Nexans shares: 314

Age: 49

Nationality: Moroccan

Address: Route de Tit-Mellil – Ain Sebaa – Boulevard Ahl Loghlam – Casablanca 20250 – Morocco

Expertise/Experience

Selma Alami is General Manager of Nexans’ North West Africa Business Unit. She started her career in 2000 in information systems at a software company (SSII) specialized in ERP integration in the medical sector. Attracted by the industrial sector, in 2001 she joined a Moroccan holding company that produced and distributed consumer products to support its mergers and acquisitions projects with regard to IT, processes and internal control. In 2003, she joined Sirmel, the distribution subsidiary of Nexans in Morocco, where she was in charge of upgrading and deploying infrastructures and information systems based on Group standards. She then held the position of CIO Morocco and later CIO MERA, before taking over the general management of the distribution subsidiary in Morocco in 2018.

After leading Sirmel in its transformation and implementation of strategic projects for its profitable growth plan through 2020, she was Deputy General Manager of the North West Africa Business Unit in charge of operations and support functions from March 2020 and became General Manager on January 31, 2022. Selma is an IS engineer and has completed a Master’s degree in Audit and Management of Information Systems at the University of Lille, France.

Directorships and other positions held during the 2024 fiscal year (and still in force at the 2024 year-end)

- –Positions held within the Nexans Group: Director of Sirmel Morocco*, Nexans Morocco* and Nexans Côte d’Ivoire*

Directorships that have expired in the last five years

- –Director of Sirmel Sénégal* and Câbleries du Sénégal*

* Positions held in foreign companies or institutions.

Jane Basson

Independent director

Head of Transformation, Corporate Secretary and member of the Executive Committee of Airbus Defence and Space

First elected as a director: May 13, 2020

Expiration of current term as director: 2028 AGM

Member of the Appointments and Corporate Governance Committee

Member of the Compensation Committee

Member of the Strategy and Sustainable Development Committee

Number of shares held: 500

Age: 55

Nationality: French

Address: Willy-Messerschmitt-Str. 1, 82024 Taufkirchen, Germany

Expertise/Experience

Jane Basson has been Head of Transformation, Corporate Secretary and member of the Executive Committee of Airbus Defence and Space since October 1, 2021. She was previously Chief of Staff to the Chief Operating Officer and Head of People Empowerment in Operations at Airbus and, prior to that, Chief of Staff to the Chief Executive Officer (CEO) (2016-2019).

Jane worked for various law firms and the Business and Industry Advisory Committee to the OECD in Paris before joining Airbus in 2000. She held various roles in Corporate Communications before being appointed Vice President Internal Communications in 2003. In 2008 she moved to human resources to develop a culture change program in support of the company’s business transformation strategy Power8 and was appointed Senior Vice President Leadership Development & Culture Change for the group in June 2012 when she set up the Airbus Leadership University. She also chairs Balance for Business, a 10,000 strong employee-led inclusion and diversity platform at Airbus.

Jane has a degree in International Communications, Journalism and Business Administration. Originally South African, Jane has French nationality and lives in Toulouse, France with her husband and daughter.

Directorships and other positions held during the 2024 fiscal year (and still in force at the 2024 year-end)

- –None

Directorships that have expired in the last five years

- –Censor of Nexans from February 19, 2020 to May 13, 2020

Laura Bernardelli

Independent director

Chief Financial Officer of the Coesia Group

First elected as a director: May 11, 2022

Expiration of current term as director: 2026 AGM

Chairwoman of the Accounts, Audit and Risk Committee

Number of shares held: 510

Age: 55

Nationality: Italian

Address: Via Battindarno, 91 – 40133 Bologna – Italy

Expertise/Experience

Laura Bernardelli is currently Chief Financial Officer of Coesia, a global leader in industrial and packaging automated solutions, starting from April 2022. Laura was the CFO of the Datalogic Group from July 2019 to March 2022 and has been in charge of investor relations since November 2020.

Prior to joining Datalogic, Laura was Senior Vice President Group Controlling, Reporting and Digital Finance at Schneider Electric, from 2017. She joined Schneider Electric in 2014 as Senior Vice President, Finance Building & IT Business.

Prior to Schneider Electric, Laura was Vice President, Corporate Strategy and Business Development at Xylem from 2011, when the company was formed from the spin-off of the water business of ITT Corporation. Laura was subsequently appointed Vice President, Finance and CFO of EMEAI. Laura joined ITT Corporation in 2007 as CFO Italy.

Previously, Laura held positions of increasing responsibility in the finance function at Fiat, General Electric and Eridania Béghin-Say; she has lived and worked internationally for almost 10 years.

Directorships and other positions held during the 2024 fiscal year (and still in force at the 2024 year-end)

- –Member of the Board of Directors of System Ceramics SpA* (Coesia Group)

- –Member of the Board of Directors of Bakel SpA (Italy) since December 16, 2024

Directorships that have expired in the last five years

- –Member of the Board of Directors of Datalogic S.r.l.*

- –Member of the Board of Directors of Datalogic IP Tech S.r.l.*

- –Censor of Nexans from September 20, 2021 to May 11, 2022

Positions held in listed French or foreign companies.

* Positions held in foreign companies or institutions.

Bpifrance Participations

represented by Karine Lenglart

Senior Investment Director, Large Cap, Bpifrance

First elected as a director: May 15, 2019

Expiration of current term as director: 2027 AGM

Member of the Strategy and Sustainable Development Committee

Member of the Appointments and Corporate Governance Committee

Member of the Compensation Committee

Number of shares held by Bpifrance Participations: 2,273,546

Age: 52

Nationality: French

Address: 6-8 boulevard Haussmann, 75009 Paris, France

Expertise/Experience

Karine Lenglart has been a Senior Investment Director, at Bpifrance's Large Cap Capital Development Department, since October 2022. She was previously and since 2016, Head of Mergers and Acquisitions and Investments at the Casino Group and a member of the Executive Committee since 2020.

She began her career in 1996, first at the Dutch investment bank ABN Amro and then at Société Générale investment bank. She then joined the Alstom Group in 2007, where she was Vice-Chair of Mergers and Acquisitions until 2015.

Karine Lenglart is a business school graduate and holds a Master’s degree in Financial Techniques from ESSEC.

Directorships and other positions held during the 2024 fiscal year (and still in force at the 2024 year-end)

- –Censor on the Board of Directors of GGE TCo 1 (Galileo Global Education)

- –Permanent representative of Bpifrance Investissement, member of the Board of Directors of Bureau Veritas and member of the Appointments and Compensation Committee (since June 20, 2024)

- –Permanent representative of Bpifrance Investissement, member of the Supervisory Board of Hygie31

- –Permanent representative of Bpifrance Investissement, member of the Strategic Committee of TSE

Directorships that have expired in the last five years

- –Member of the Board of Directors of Perspecteev (Bankin’)

- –Permanent representative of Bpifrance Investissement, member of the Supervisory Board of EMSponsors

Marc Grynberg

Independent director

Director responsible for monitoring climate and environmental issues

First elected as a director: May 11, 2017

Expiration of current term as director: 2025 AGM

Director responsible for monitoring climate and environmental issues since January 20, 2022

Member of the Strategy and Sustainable Development Committee

Member of the Accounts, Audit and Risk Committee

Number of shares held: 2,000

Age: 59

Nationality: Belgian

Address: 4 allée de l’Arche, 92400 Courbevoie, France

Expertise/Experience

Marc Grynberg was Chief Executive Officer (CEO) of Umicore from November 2008 to October 2021. He was head of the Group’s Automotive Catalysts business unit from 2006 to 2008 and served as Umicore’s CFO from 2000 until 2006. He joined Umicore in 1996 as Group Controller. Marc holds a Commercial Engineering degree from the University of Brussels (École de Commerce Solvay) and, prior to joining Umicore, worked for DuPont de Nemours in Brussels and Geneva.

Directorships and other positions held during the 2024 fiscal year (and still in force at the 2024 year-end)

- –Member of the Supervisory Board of Wienerberger*, member of the Sustainable Development and Innovation Committee and the Audit and Risk Committee

- –Member of the Supervisory Board of Umicore*, member of the Investment Committee and the Audit Committee

Directorships that have expired in the last five years

- –Chief Executive Officer (CEO) of Umicore*

- –Positions held within the Umicore Group*

- –Chairman of the Supervisory Board of Umicore Management AG (Germany)*

- –Chairman of the Board of Directors of Umicore Poland Sp. z.o.o.*, Umicore Japan KK* and Umicore Marketing Services Korea Co. Ltd*

- –Director of Umicore Marketing Services (Hong Kong) Ltd*, and Umicore Korea Ltd*

Positions held in listed French or foreign companies.

* Positions held in foreign companies or institutions.

Oscar Hasbún Martínez

Director proposed by Invexans Limited (Quiñenco Group)

Chief Executive Officer (CEO) of CSAV (Compañía Sud Americana de Vapores S.A.)

First elected as a director: May 15, 2019

Expiration of current term as director: 2027 AGM

Chairman of the Strategy and Sustainable Development Committee

Number of shares held: 500

Age: 55

Nationality: Chilean

Address: Av. Apoquindo 2827, piso 14, Las Condes, Santiago, Chile

Expertise/Experience

Oscar Hasbún Martínez is Chief Executive Officer (CEO) of CSAV (Compañía Sud Americana de Vapores S.A.), member of the Supervisory Board of Hapag-Lloyd AG and a member of its Audit and Finance Committee. From 1998 to 2002, he was Managing Director and member of the Executive Board of the Chilean subsidiary of Michelin. He then joined the Quiñenco Group, where he was in charge of its investments in Croatia. In 2011, he was appointed Chief Executive Officer (CEO) of CSAV, where he oversaw the shipping company’s transformation, restructuring and subsequent merger with Hapag-Lloyd AG. Oscar Hasbún Martínez has a degree in business administration from Universidad Católica of Chile.

Directorships and other positions held during the 2024 fiscal year (and still in force at the 2024 year-end)

- –Positions held within Quiñenco Group companies:

- –Chief Executive Officer (CEO) of CSAV* (Compañía Sud Americana de Vapores S.A.)

- –Member of the Supervisory Board and Deputy Vice-Chairman of the Supervisory Board of Hapag Lloyd AG*

- –Chairman of the Board of Directors of SM SAAM* (Sociedad Matriz SAAM S.A.), a listed company that invests in ports, tug boats and logistics in America

- –Director of Invexans SA*, which owns 100% of Invexans UK Ltd (Nexans’ main shareholder)

- –Director of CCU* (Compañía Cervecerías Unidas S.A.), Compañía Cervecerías de Chile S.A.*, ECCUSA*

- –Advisor of SOFOFA* (professional non-profit federation of Chilean industry and trade unions)

Directorships that have expired in the last five years

- –Director of various subsidiaries of SM SAAM*: SAAM S.A.*, Florida International Terminal LLC*, Sociedad Portuaria de Caldera (SPC) S.A.*, Sociedad Portuaria Granelera de Caldera (SPGC) S.A.*, San Antonio Terminal Internacional S.A.*, San Vicente Terminal Internacional S.A.*

Positions held in listed French or foreign companies.

* Positions held in foreign companies or institutions.

Tamara de Gruyter

Independent director

President Portfolio Business and member of the Executive Committee of Wärtsilä

First appointment as a censor: March 20, 2024

First elected as a director: May 16, 2024

Expiration of current term as director: 2028 AGM

Member of the Appointments and Corporate Governance Committee

Member of the Compensation Committee

Member of the Accounts, Audit and Risk Committee

Number of shares held: 35

Age: 52

Nationality: Dutch

Address: Wärtsilä Netherlands - James Wattlaan 23, 5151 DP Drunen, Netherlands

Expertise/Experience

Tamara de Gruyter is President Portfolio Business and member of the Executive Committee of Wärtsilä.

She began her career in 1996 at LIPS, which was acquired in 2002 by Wärtsilä. Tamara has held various management positions within the company, both in the Maritime and Services sectors. She was Chief Executive Officer (CEO) of two joint ventures in China and of the pumps business in Singapore. Back in Europe, she held various Vice-President positions before becoming Chief Transformation Officer at the end of 2019. Tamara has been a member of the Wärtsilä Executive Committee since 2020 as President Marine Systems. Since January 1, 2024, Tamara has been President Portfolio Business.

Tamara is a graduate of the École polytechnique of Haarlem and holds a degree in shipbuilding engineering.

Directorships and other positions held during the 2024 fiscal year (and still in force at the 2024 year-end)

- –Director of Combient Oy*

- –Positions held within the Wärtsilä Group:

- –Chairwoman of the Board of Directors of Wärtislä Suzhou China*, Wärtislä Gas Solutions Norway*, Wärtsilä SAM Electronics*, Wärtsilä Water Systems*, Wärtsilä Gas Solutions Sweden*

- –Director of Wärtsilä Lyngsoe Marine*, Wärtsilä APSS S.r.l.*

Directorships that have expired in the last five years

- –Chairwoman of the Board of Directors of Trident B.V.*, American Hydro*, Wärtsilä Defence Solutions*

Anne Lebel

Lead Independent Director

Chief Human Resources Officer of the Capgemini Group and member of the Executive Board

First elected as a director: May 17, 2018

Expiration of current term as director: 2026 AGM

Chairwoman of the Appointments and Corporate Governance Committee

Chairwoman of the Compensation Committee

Number of shares held: 500

Age: 59

Nationality: French

Address: 11 rue de Tilsitt, 75017 Paris, France

Expertise/Experience